What is the story about?

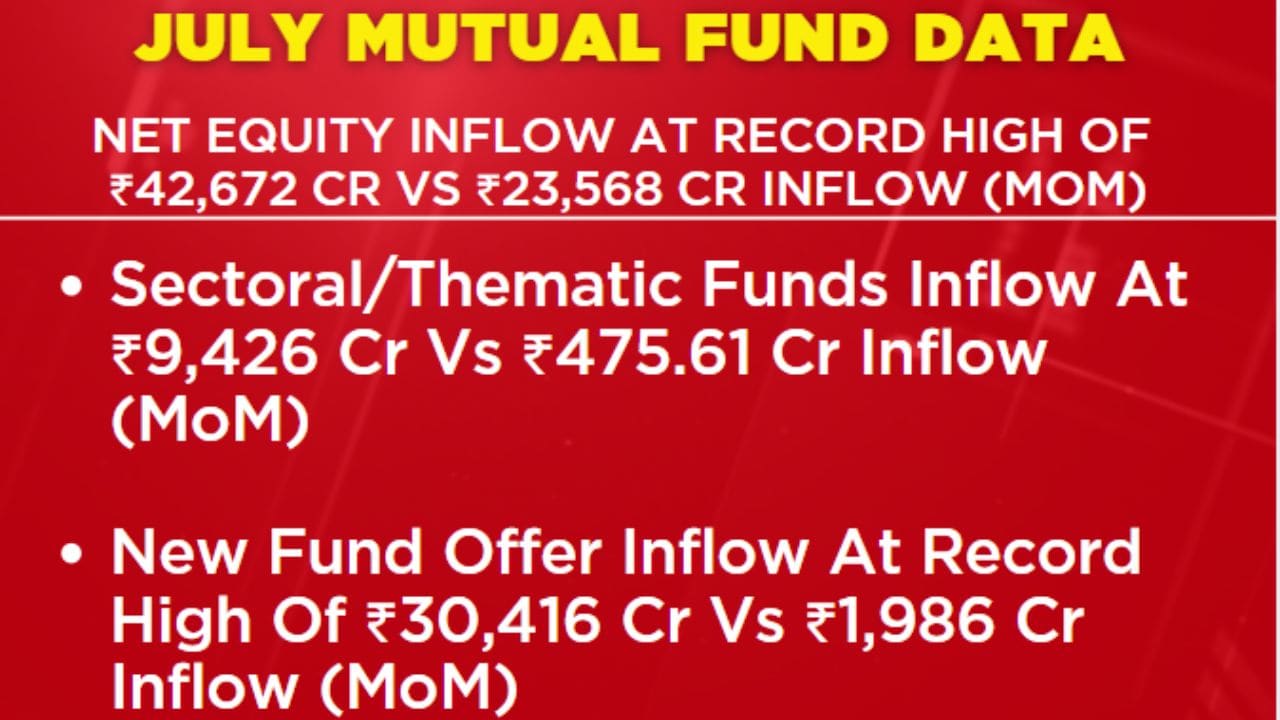

Inflows into thematic mutual funds jumped to ₹9,426 crore in July, their highest level since December 2024, data from the Association of Mutual Funds in India (AMFI) showed on Monday (August 11). In June, the inflows were at just ₹475.6 crore.

According to Himanshu Srivastava, Principal, Manager Research, Morningstar Investment Research India, the surge in thematic inflows was propelled by the launch of seven new schemes that collectively mobilised ₹7,404 crore.

"While investor interest in this segment seems to be coming back and remains strong, it is important to note the higher inherent risks of concentrated thematic bets, warranting alignment with individual risk profiles," Srivastava said.

While existing thematic funds are also drawing capital, the bulk of the inflows is being driven by newly launched products targeting sectors investors believe will outperform in the medium to long term.

What makes thematic funds different?

Thematic funds invest in specific sectors or themes - such as technology, infrastructure, manufacturing, energy or ESG (environment, social, and governance). This is different than diversified equity funds that spread bets across industries.

This focused approach can magnify returns when the chosen sector is performing well but also raises risk if the trend reverses.

Also Read:Equity mutual fund inflows cross ₹40,000 crore for first time in July

Thematic funds emerged as the second largest contributor to overall equity inflows in July, behind new fund offerings.

In July, NFOs mobilised ₹30,416 crore

- the highest monthly collection on record.

According to Himanshu Srivastava, Principal, Manager Research, Morningstar Investment Research India, the surge in thematic inflows was propelled by the launch of seven new schemes that collectively mobilised ₹7,404 crore.

"While investor interest in this segment seems to be coming back and remains strong, it is important to note the higher inherent risks of concentrated thematic bets, warranting alignment with individual risk profiles," Srivastava said.

While existing thematic funds are also drawing capital, the bulk of the inflows is being driven by newly launched products targeting sectors investors believe will outperform in the medium to long term.

What makes thematic funds different?

Thematic funds invest in specific sectors or themes - such as technology, infrastructure, manufacturing, energy or ESG (environment, social, and governance). This is different than diversified equity funds that spread bets across industries.

This focused approach can magnify returns when the chosen sector is performing well but also raises risk if the trend reverses.

Also Read:Equity mutual fund inflows cross ₹40,000 crore for first time in July