Finance Minister Nirmala Sitharaman, while presenting the Union Budget 2026–27, did not announce any changes to the income tax slabs under the new tax regime,

effectively maintaining the structure introduced in last year’s Budget.

The existing rates and thresholds will continue to apply from Assessment Year (AY) 2026–27, signalling policy continuity rather than fresh tax relief for salaried individuals.

Key takeaways include:

- Income tax slabs under the new regime remain unchanged.

- Standard deduction for salaried taxpayers continues at ₹75,000.

No significant new concessions for senior citizens, housing, or savings instruments were flagged in the Budget speech.

Last year, the government effectively raised the tax-free income threshold to ₹12 lakh through rebates, while retaining a standard deduction of ₹75,000 for salaried individuals. This allowed zero tax liability on income up to ₹12.75 lakh for salaried taxpayers.

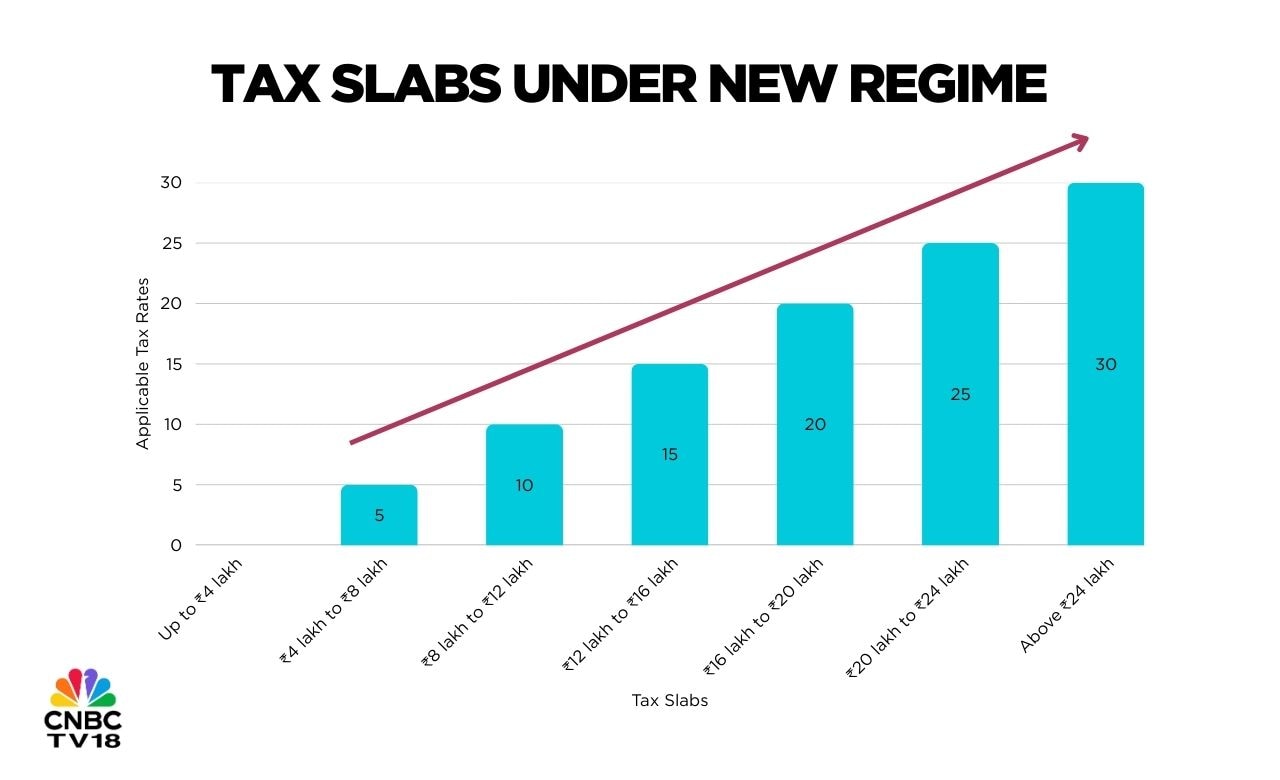

Under the existing new tax regime, income tax slabs are:

- Nil: Up to ₹4 lakh

- 5%: ₹4 lakh to ₹8 lakh

- 10%: ₹8 lakh to ₹12 lakh

- 15%: ₹12 lakh to ₹16 lakh

- 20%: ₹16 lakh to ₹20 lakh

- 25%: ₹20 lakh to ₹24 lakh

- 30%: Above ₹24 lakh

These slabs apply for assessment year 2026–27 as well.

Budget 2025 had also introduced relief for homeowners by allowing two self-occupied houses to be treated as tax-free, increased interest deduction limits for senior citizens, and simplified TDS and TCS rules.

Changes were also made to the taxation of ULIPs, updated income tax return filing timelines, and incentives for startups.

New income tax law on the horizon

Separately, the government reiterated that the Income Tax Act, 2025 will come into force from April 1, 2026, replacing the Income Tax Act, 1961. The new law focuses on simplified language, updated procedures, and greater use of technology, while keeping the core tax structure broadly unchanged.

Catch LIVE updates on Budget here