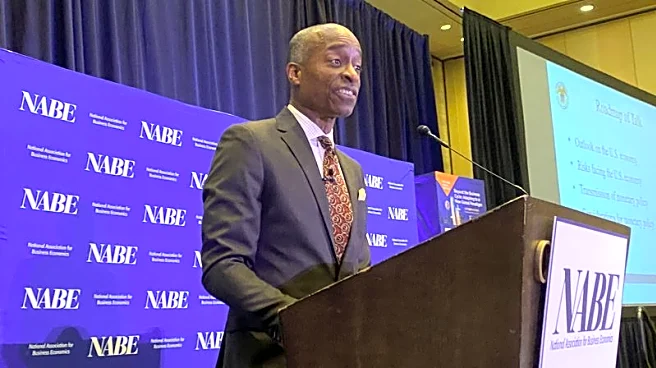

BOCA RATON, Florida, Jan 16 (Reuters) - Federal Reserve Vice Chair Philip Jefferson on Friday appeared to signal his support for leaving short-term borrowing costs unchanged at the central bank's January

27-28 meeting, saying he is "cautiously optimistic" about the economy, the labor market and inflation in the coming year now that the Fed's rate cuts have put monetary policy in the range of neutral.

"While I do not want to prejudge the decision that will take place there, in my view, the current policy stance leaves us well positioned to determine the extent and timing of additional adjustments to our policy rate based on the incoming data, the evolving outlook, and the balance of risks," Jefferson said in his first public remarks on monetary policy since November, before the Fed delivered the third of a string of quarter-percentage-point interest rate cuts that brought the policy rate to its current 3.50%-3.75% range.

Jefferson voted in the 9-3 majority to support December's reduction. His remarks on Friday echoed language on the "extent and timing" of future moves that was included in the Fed's December post-meeting statement and was widely interpreted as signaling a pause on any further action in the new year.

Last year's rate cuts were "the right step to balance the upside risk of persistent above-target inflation and the downside risk of a deteriorating labor market," Jefferson said in remarks prepared for delivery to the American Institute for Economic Research, Shadow Open Market Committee, and Florida Atlantic University Conference. "This policy stance puts the economy in a good position moving forward."

In the new year, Jefferson said on Friday, the economy will likely grow at around 2% in the near term, the unemployment rate - at 4.4% in December - will likely remain steady, and inflation, despite upside risks, will likely return to a sustainable path toward the Fed's 2% goal.

Though the rise in core goods prices last year is inconsistent with that pathway, he said, "it is a reasonable base case that the effects of tariffs on inflation will not be long-lasting - effectively, a one-time shift in the price level," especially with inflation expectations remaining anchored.

Financial markets are currently pricing only a 5% chance of a rate cut this month.

(Reporting by Howard Schneider; Writing by Ann Saphir; Editing by Andrea Ricci)