By Jonathan Stempel

NEW YORK, Jan 15 (Reuters) - A former chief executive of Emergent BioSolutions was charged on Thursday with insider trading by New York Attorney General Letitia James for allegedly selling the contract drug manufacturer's stock while knowing about contamination problems at a Baltimore plant that made COVID-19 vaccines.

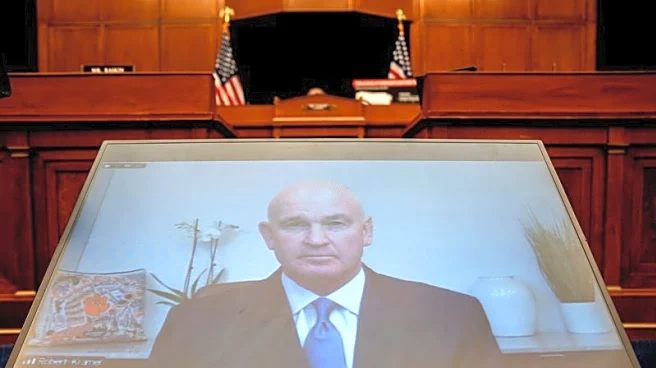

Robert Kramer was accused in the civil lawsuit of violating the Martin Act, a powerful state securities law, by generating $10.12 million of illegal profit under

a so-called 10b5-1 stock trading plan he set up shortly after learning in October 2020 about tainted batches of AstraZeneca vaccines at Emergent's plant.

The sales ended shortly before Emergent's share price began declining as concerns mounted about the plant, where vaccine production was halted in April 2021 because of contamination.

Emergent, based in Gaithersburg, Maryland, agreed to pay a $900,000 civil fine for approving Kramer's trading plan, and will tighten its insider trading policy.

"The lawsuit against Mr. Kramer is baseless and an overreach," his lawyer Kirby Behre said in an email. "Mr. Kramer followed company procedures and federal rules regarding 10b5-1 plans, (and) is confident that the facts will show that this suit should never have been brought."

Emergent said it has "taken significant action to improve transparency and integrity" throughout its operations.

Named for a U.S. Securities and Exchange Commission rule, 10b5-1 plans let insiders at public companies sell shares at predetermined times to shield against accusations their sales might be timed to negative corporate news.

James said Kramer's sales ended on February 8, 2021, shortly before analysts publicly questioned the Baltimore plant's slow vaccine production.

Johnson & Johnson's COVID-19 vaccine was also produced at the plant, and the U.S. Food and Drug Administration halted production on April 16, 2021, after learning that the vaccine had been contaminated by ingredients from AstraZeneca's vaccine.

Emergent eventually destroyed tens of millions of vaccine doses.

“Corporate executives who use insider information to illegally trade company stocks and make a profit betray the public’s trust,” James said in a statement. "Kramer’s actions were illegal and unethical."

Kramer retired from Emergent in June 2023.

James filed her complaint in a New York state court in Manhattan. Emergent's share price has fallen about 90% since Kramer completed his stock sales.

(Reporting by Jonathan Stempel in New York; Editing by Hugh Lawson and Aurora Ellis)