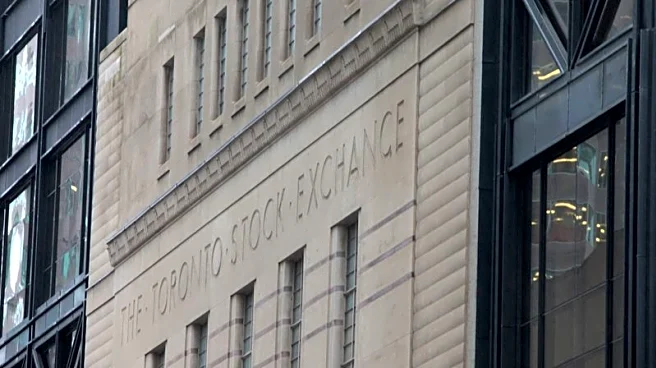

(Reuters) -Futures tied to Canada's main stock index steadied on Friday after the previous session's losses, as attention shifted to an upcoming high-stakes U.S.–Russia summit to discuss a potential end to the war in Ukraine.

The futures on the S&P/TSX index rose 0.04% by 05:30 a.m. ET (0930 GMT), following the S&P/TSX composite index's losses on Tuesday, when a hotter-than-expected U.S. inflation report clouded hopes for a Federal Reserve interest rate cut.

According to the CME Group's FedWatch tool,

odds for a 25-basis-point reduction next month reduced to 92.6% from the previous 100% before the data, while bets for a hefty 50-bps move have completely vanished.

The stage was set for talks between U.S. President Donald Trump and Russian leader Vladimir Putin in Alaska later on Friday, although hopes for a lasting ceasefire to end the conflict in Ukraine remain slim.

Ahead of the summit, oil prices slipped on heightened concerns about fuel demand due to largely disappointing economic data from the U.S. and China. [O/R]

Gold prices remained steady but were poised for a weekly decline, while copper was on track to post gains for the week. [GOL/] [MET/L]

Despite Thursday's losses, expectations for Fed easing have kept Canadian equities on track to finish the week higher. The TSX is up 0.56% so far this week.

About 75% of Canada's exports go to the U.S., with much of them exempt from tariffs under the continental trade pact. So, a Fed move could also benefit Canada.

At 8:30 a.m. ET, domestic investors will digest June manufacturing sales and wholesale trade data. Later in the day, U.S. releases include import prices, consumer sentiment and retail sales.

In other news, Air Canada and its flight attendants remained at odds on Friday, despite government pleas to resume bargaining and avert a strike.

FOR CANADIAN MARKETS NEWS, CLICK ON CODES:

TSX market report [.TO]

Canadian dollar and bonds report [CAD/] [CA/]

Reuters global stocks poll for Canada

Canadian markets directory

($1 = 1.3793 Canadian dollars)

(Reporting by Nikhil Sharma; Editing by Vijay Kishore)