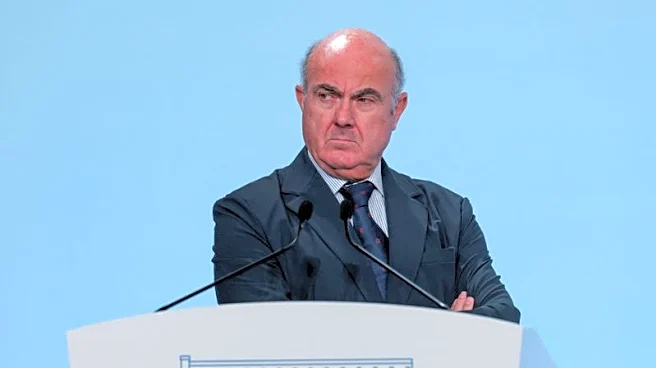

Jan 15 (Reuters) - The European Central Bank's cooperation with the U.S. Federal Reserve will continue, ECB Vice-President Luis de Guindos told Politico in an interview published on Thursday, reaffirming

support for the principle of central bank independence.

De Guindos was asked whether, in the light of Trump administration attempts to unseat Fed Chairman Jerome Powell, the ECB could continue to trust the Fed as a partner in the event of a financial crisis.

"I can assure you that, so far, our cooperation with the Federal Reserve has been normal, business as usual," he said.

"Swap lines between the Fed and other central banks and the delivery of dollars are positive for financial stability on both sides of the Atlantic and that's why we believe that cooperation will continue."

A currency swap line is an agreement between two central banks to exchange currencies. This allows a central bank to obtain foreign currency liquidity from the central bank that issues it – usually because they need to provide this to domestic commercial banks.

Last November the ECB told euro zone lenders with big dollar businesses they should bulk up their liquidity and capital cushions to withstand any squeeze in a U.S. currency made more volatile by Trump's actions.

After the ECB and other central banks this week issued an unprecedented statement of support for Powell, de Guindos reaffirmed that central bank independence was the best way to keep inflation under control.

"It is very important for all of us that the principle of central bank independence is also applied to the Federal Reserve," he said.

Asked about reports last year that there were informal, staff-level discussions between central banks about pooling their own dollar reserves as an alternative to Fed funding backstops, de Guindos did not comment on those reports but said:

"We have not discussed anything in that regard, neither in the (ECB) Executive Board nor in the Governing Council."

(Writing and reporting by Mark John; Editing by Alexandra Hudson)