By David Lawder

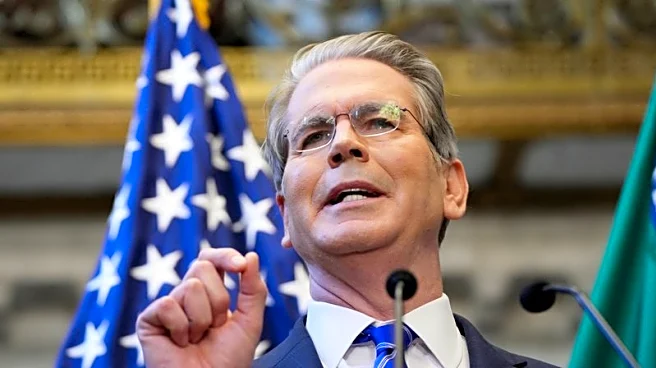

WASHINGTON (Reuters) -The Trump administration will seek to tighten control over strategic sectors by taking more equity stakes in key companies to counter China's economic policies and

export restrictions, Treasury Secretary Scott Bessent said on Wednesday.

Bessent told a CNBC event that China's dramatic new restrictions on rare earth minerals and magnets demonstrates the need for the U.S. to be self-sufficient in critical materials or rely more on trusted allies.

"So when you are facing a non-market economy like China, then you have to exercise industrial policy," Bessent said.

Under President Donald Trump, the U.S. has shifted from subsidies to direct stakes in companies including Intel Corp, minerals miner Trilogy Metals and rare earths miner MP Materials.

More stakes are possible for sectors important to U.S. national security, including in rare earths, semiconductors, pharmaceuticals and steel, Bessent said. In rare earths, the administration will also set price floors and strategic stockpiles.

"We're not going to come in and take stakes in non-strategic industries, but we've identified seven industries" to develop domestically, Bessent said. The government had to be "very careful not to overreach" and to ensure that investments were meeting its strategic goals, he added.

Bessent also criticized the practices of some defense contractors, saying the government may have to put more pressure on them to improve performance.

"I do think our defense companies are woefully behind in terms of deliveries, so we may have to, as their biggest customer ... prod them to do a little more research, a little fewer stock buybacks, which is really what got Boeing into trouble," he said.

(Reporting by David Lawder; Editing by Stephen Coates)