By Marc Jones

LONDON, Jan 6 (Reuters) - What matters in U.S. and global markets today

Global stocks’ march to ever-higher peaks undefined is still going strong, although both Wall Street futures and the dollar look a tad groggy this morning. Perhaps there's a bit of a delayed hangover kicking in this morning after all the new year’s excitement.

I’ll get into all the market news below.

But first check out the latest episode of the Morning Bid podcast and remember to subscribe to hear top Reuters journalists

discuss the biggest news in markets and finance seven days a week.

Today's Market Minute

* Toppled Venezuelan President Nicolas Maduro pleaded notguilty on Monday to narcotics charges after President DonaldTrump's stunning capture of him rattled world leaders and leftofficials in Caracas scrambling to regroup. * Geopolitics, U.S. midterm elections and diverging monetarypolicies are likely to be among the key drivers for worldmarkets in 2026, alongside an artificial intelligence boom thathas raised concerns about a tech share bubble. * An unknown trader has raked in a profit worth about$410,000 after betting that Venezuelan president Nicolas Madurowould be ousted from his position. * Nvidia CEO Jensen Huang said on Monday that the company’snext generation of chips is in “full production,” saying theycan deliver five times the AI computing of the company’sprevious chips when serving up chatbots and other AI apps. * U.S. President Donald Trump is giving U.S. energycompanies the opportunity to revive Venezuela’s massive,derelict oil industry. It’s an offer they may want to refuse,writes ROI Energy Columnist Ron Bousso.SWIFTLY MOVING ON

Wall Street is expecting a nice quiet start. There is little on the U.S. data calendar other than the normally non-market moving 'final' PMIs for December, although traders only have to wait until Friday for the first nonfarm payrolls of the year and whether they need to adjust their thinking on how many interest rate cuts the Federal Reserve might deliver this year.

Otherwise, markets will continue to watch Donald Trump's evolving plans to “run” Venezuela - and try and gauge just how much that could end up costing (or earning) the U.S.

A little over 72 hours since the removal of Venezuelan President Nicolas Maduro, few marks have been left on the currency market. Monday’s initial bolt for dollar safety has proved very short-lived, as signs of dialogue between the White House and Maduro’s successor, Delcy Rodríguez, suggest further U.S. military action is unlikely for now.

December ISM manufacturing index data also played a role. It dropped below 48 on Monday, a fourth consecutive monthly decline and to the lowest level since October 2024. The backlog of orders also continued to shrink, suggesting a risk of inventory build-up and a potential hit to employment in the months ahead - something Fed official Neel Kashkari also happened to point out.

Back to today and oil is ticking up again too. All the talk of a glut of Venezuelan crude driving down prices looks to have been clipped by the reality that it will take years - and billions of dollars - that the U.S. oil majors might not jump at forking out. Gold and silver have continued to nudge up, however, as has Wall Street's so-called fear gauge the VIX, although that really is from rock-bottom levels.

As for Venezuela's Maduro, his situation appears pretty clear. He is expected to be convicted by the Southern District of New York on at least one of the four charges - narco-terrorism, cocaine importation conspiracy and possession of machine guns and destructive devices - levied against him, and will likely spend the rest of his life in jail.

Chart of the day

One of the things that has been most striking about Maduro's shock weekend capture is that barring Venezuela's default-stricken government bonds and some of the share prices of the oil majors, it barely seems to have registered for broader global markets.

The dollar, which would normally expect a safe-haven bid, is back on the ropes this morning, crude prices are almost exactly where they were this time last week and with MSCI's main world stocks benchmark already at its second record high of the year, volatility is threatening to go extinct.

Today's events to watch

Final S&P U.S. PMIs for December

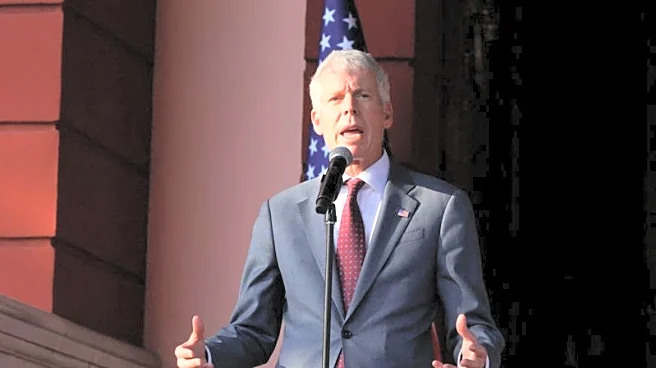

Richmond Federal Reserve President Thomas Barkin speaks

U.S. Federal Reserve Governor Stephen Miran speaks

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Want to receive the Morning Bid in your inbox every weekday morning? Sign up for the newsletter here.

(By Marc Jones; Editing by William Maclean)