By David Lawder and Andrea Shalal

GOLDEN VALLEY, Minnesota, Jan 8 (Reuters) - U.S. Treasury Secretary Scott Bessent on Thursday said he was confident in the ability to reconstitute any lost tariff revenue

by imposing duties under other legal authorities if the Supreme Court rules against President Donald Trump's emergency tariffs, but a loss would undercut Trump's flexibility and leverage.

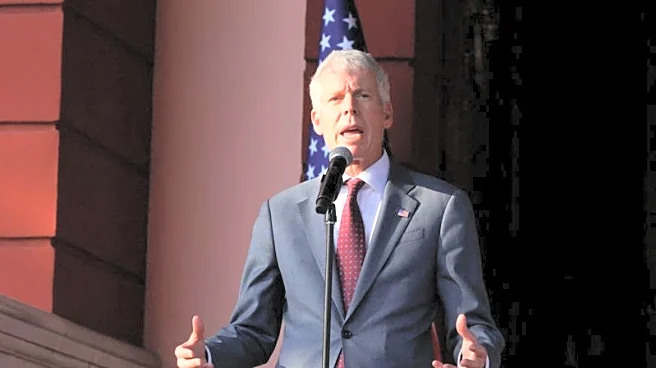

Bessent, speaking at an Economic Club of Minnesota event at which he touted the benefits of the administration's economic agenda and discussed some of its plans in Venezuela following the removal of the South American country's leader, defended the tariffs under the International Emergency Economic Powers Act as bringing China, Mexico and Canada to the negotiating table to curb fentanyl trafficking.

"What is not in doubt is our ability to continue collecting tariffs at roughly the same level in terms of overall revenue," Bessent said. "What is in doubt, and it's a real change for the American people, was the president loses flexibility to use tariffs, both for national security, for negotiating leverage."

The levies used under IEEPA have offered Trump significant clout, Bessent said, citing as an example his threat of 100% tariffs on Chinese imports in retaliation for its threat to put export controls on rare earths magnets critical to many U.S. manufacturing industries.

"My phone started immediately ringing when he said we'll do 100% tariffs," Bessent said. "So he brought them to the table. That was a long way of saying we'll lose national security ability, flexibility."

The IEEPA tariffs have contributed sizably to the roughly $30 billion in customs duties revenues now collected each month, a four-fold increase from the inflow before Trump's return to the White House a year ago. Bessent said the use of other authorities that give the right to impose tariffs to protect national security or retaliate against unfair trade practices would allow the administration to keep that revenue stream largely intact.

"So I would not imagine that we would see much, if any, revenue diminishing," Bessent said. What would be diminished "is just the ability to implement and negotiate."

Bessent's comments come a day before the U.S. high court is set to issue its first rulings of 2026, which could include a decision on the highly anticipated case over Trump's use of IEEPA to justify an aggressive barrage of import taxes that have helped raise the average tariff in imported goods to nearly 17% from less than 3% at the start of 2025.

TAX RETURN SEASON TO START EARLY

On other matters, Bessent said an early start to the 2026 tax filing season would provide a tailwind to the U.S. economy by allowing benefits from Republican-passed tax breaks to flow quickly to Americans.

Bessent said the Internal Revenue Service would begin accepting tax returns on January 26, one of the earliest starts in a decade.

Bessent called on the Federal Reserve to have an "open mind" in setting monetary policy and "do its part" to help spur investment.

Regarding Venezuela, the oil-rich Latin American country whose long-time leader Nicolas Maduro was captured by U.S. forces last weekend and brought to New York to face drug-trafficking charges, Bessent said the largest oil companies are likely to move slower in terms of making investments there, with wildcatters or independent oil companies likely to move much more quickly.

Treasury's role there would be to remove sanctions on various entities in the country, while imposing new sanctions on others, he said.

"And then Treasury will oversee - as the asset sales of the oil are done - Treasury will oversee the account," Bessent said, adding Treasury would handle disbursement of funds back into Venezuela at the direction of President Donald Trump and Secretary of State Marco Rubio.

(Reporting by David Lawder in Minnesota and Andrea Shalal in Washington; writing by Dan Burns, Editing by Chizu Nomiyama )