By Kiyoshi Takenaka

TOKYO, Jan 15 (Reuters) - More than two-thirds of Japanese firms expect the economy to suffer from frayed ties with China, with nearly half reporting or anticipating a direct business impact, a Reuters survey showed on Thursday.

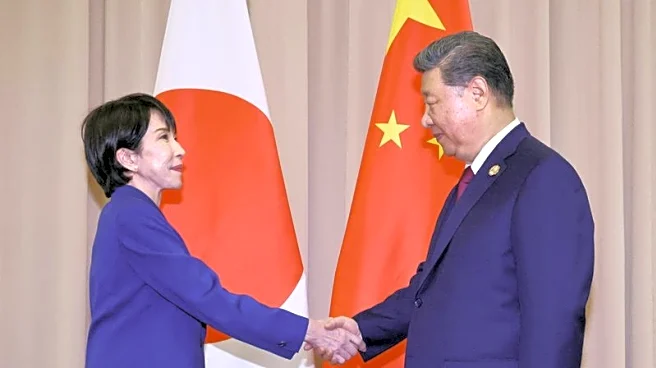

Relations between Asia's two largest economies have soured since Prime Minister Sanae Takaichi in November said a Chinese attack on democratically governed Taiwan could be deemed an existential threat to Japan. China called the remark "provocative."

China

regards Taiwan as its territory, which Taipei rejects.

About 9% of survey respondents said their business has already been affected by the issue, while 35% expect some sort of impact.

China has advised its citizens against travel to Japan since the remark. It has also banned exports to Japan of items that can have a military application, stoking concern of curbs on rare-earth shipments vital to the automotive and electronics sectors.

"A decline in the number of Chinese travellers is beginning to weigh on the utilisation rate and per-room revenue of our hotel business," a manager at a railroad operator wrote in the survey.

An official at an electronics maker said China's policy direction on rare earths is a "matter of life and death" for the company.

Japan has strived to reduce its reliance on China for rare earths in recent years but its Asian neighbour still accounts for about 60% of imports.

About 43% of respondents said prolonged deterioration in bilateral relations would likely lead to a review of China-related business.

"If Japanese automakers' sales were affected in China, our sales would decline and we would face the possibility of withdrawing from business in China," said a manager at a transportation equipment manufacturer.

An official at a chemical firm said a protracted diplomatic dispute would prompt the company to reduce China's weighting in sales and procurement.

The poll was conducted by Nikkei Research for Reuters from December 24 through January 7. Nikkei Research reached out to 494 companies of which 237 responded on condition of anonymity.

INTEREST RATE HIKES

On monetary policy, roughly two-thirds of respondents said the Bank of Japan's latest policy interest rate increase was appropriate, whereas 18% called it premature and 11% said it was late.

The BOJ last month raised the rate to a 30-year high of 0.75% from 0.5%, in another move away from decades of massive monetary support and near-zero borrowing costs.

"It was inevitable," a transportation firm official said. "For companies with heavy debt, the lower interest rate is, the better."

If the bank does not raise its policy rate, then "in the long term, further depreciation of the yen is likely to be a severe blow to the economy," the official said.

Asked about desirable timing for the next hike, 32% picked the second half of 2026, 21% chose the second quarter of this year and 18% selected the current quarter ending March 31. About 17% said they did not want a hike at all.

BOJ Governor Kazuo Ueda has said the central bank will continue to raise its policy rate if economic and price developments move in line with its forecasts.

About one-third of respondents said capital investment would be hampered if the rate reaches 1.0%, while 21% put that threshold at the current 0.75% and 18% said capital expenditure would be unaffected until the rate exceeds 1.5%.

(Reporting by Kiyoshi Takenaka; Editing by Christopher Cushing)