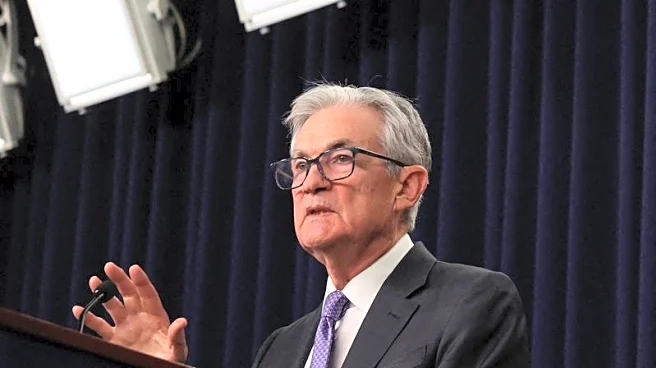

SINGAPORE, Jan 12 (Reuters) - Tensions between the White House and the U.S. central bank sharply escalated over the weekend, with Federal Reserve Chair Jerome Powell saying the administration had threatened

him with a criminal indictment related to the Fed headquarters renovation.

Powell called the threats a "pretext" aimed at putting pressure on the Fed to cut interest rates. The U.S. dollar fell broadly, U.S. stock futures slid and Treasury futures rallied.

Here is what investors and market analysts are saying about the rift:

DAMIEN BOEY, PORTFOLIO MANAGER, WILSON ASSET MANAGEMENT, SYDNEY

"Fed Chair Powell has deviated from his previous approach to Trump's threats, this time choosing to directly address the elephant in the room - that the Fed is not moving rates as the President would like.

"In response to the announcement of a criminal investigation, gold has strengthened, equities have wobbled, and the yield curve has steepened a little. These moves have been broadly consistent with the playbook for an attack on the Fed’s independence.

"What has been interesting, however, is that the yield curve has bull steepened initially (rather than bear steepened), because bond investors have taken the view that the Fed is already moving directionally with the President (rate cuts), and that its Reserve Management Purchases (RMPs) of bonds, are helping to suppress rates volatility.

"It remains to be seen how long we will see equities weaker while bonds rally, because the current macro backdrop supports positive (rather than negative) bond-equity correlation. But it makes sense to be taking on more commodities exposure in the event of an ongoing attack on Fed independence."

ALEX MORRIS, CEO OF F/M INVESTMENTS, WASHINGTON, D.C.

"Trump is making it very clear that he wants Powell off the board altogether in May.

"Of course, he doesn't have to go until his term on the board is up, and he could fight the charges and win. The statement he gave was pretty defiant in tone.

"It's a deliberate effort to undermine institutions that the president sees as standing in his way, in policy terms.

"It's also a bit of theater, in terms of the message it's sending to other Fed governors and to whoever Trump nominates to replace Powell as chair: your job is to do what I want you to do."

CHRISTOPHER HODGE, CHIEF U.S. ECONOMIST FOR INVESTMENT BANK NATIXIS, NEW YORK

"The market has shaken off so much noise around the Fed and Fed independence and I think is probably likely to do it again, but at some point things will break.

"Obviously I can't speak to the merits of the investigation, but it certainly appears as if the DOJ is trying to intimidate the Fed. If the administration keeps probing, some form of malfeasance will pop up - it would be the case in any bureaucracy - and at some point the markets will revolt."

BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT, MENOMONEE FALLS, WISCONSIN

"Powell may protest by staging a sit-in. His term as Chair is up in May, but his term as a governor isn’t up until January 2028. With the political pressure on the Fed, he may choose to stay on as a governor out of spite. It would deprive President Trump of the ability to stack the board with another appointee. Stephen Miran’s term is up in January 2026 and that may be the only vacancy Trump gets to fill. It would be unconventional for Powell to stay on, but everything these days is unconventional."

RAY ATTRILL, HEAD OF FX STRATEGY, NATIONAL AUSTRALIA BANK, SYDNEY

"This creates a huge level of uncertainty over whether Powell would resign his board of governors' seat when his term ends. He's not obligated to do that, even though there's no precedent for it.

"Powell has had enough of the carping from the sidelines and is clearly going on the offensive. This open warfare between the Fed and the U.S. administration - and to the extent that you take Powell's comments at face value - it's clearly not a good look for the U.S. dollar."

CHARU CHANANA, CHIEF INVESTMENT STRATEGIST, SAXO BANK, SINGAPORE

"A criminal inquiry into the sitting Fed Chair forces investors to price an institutional risk premium, because the perception of Fed independence matters almost as much as, if not more than, the next rate decision.

"The key question is whether this becomes a policy distraction at a delicate moment. The Fed is trying to keep the narrative anchored to inflation/growth - this headline drags attention toward governance, oversight, and politics.

"This injects a new source of volatility: not inflation data, but governance risk — and governance risk tends to show up first in FX and gold, then in rate volatility."

JOE CAPURSO, HEAD OF FOREIGN EXCHANGE, INTERNATIONAL AND GEOECONOMICS, COMMONWEALTH BANK OF AUSTRALIA, SYDNEY:

"You've seen the U.S. dollar sell off against every currency, even currencies you normally expect to see fall, including the Australian and the New Zealand dollars.

"But everyone knows that President Trump doesn't like Powell (and) putting aside what it means to Powell personally, I don't think it's going to mean anything for Fed policy in the near term."

KYLE RODDA, SENIOR MARKET ANALYST, CAPITAL.COM, MELBOURNE

"A meaningful move in the U.S. dollar and a thinly veiled attempt by the administration to strong-arm the Fed. It's another threat to Fed independence. Not good as far as the markets are concerned. Negative for the US dollar and Treasuries."

JEREMY KRESS, ASSOCIATE PROFESSOR OF BUSINESS LAW, UNIVERSITY OF MICHIGAN, MICHIGAN

"This investigation appears to be entirely pretextual, just like the investigation of Governor Cook last year. President Trump is so desperate to gain control of the Fed that he’s yet again weaponising federal law enforcement to try to take out his political enemies."

VISHNU VARATHAN, HEAD OF MACRO RESEARCH, ASIA EX-JAPAN, MIZUHO, SINGAPORE

"The Fed independence question is now well and alive and maybe subject to re-evaluation every few meetings.

"I think I'm still not sure how sustained and adversarial the attack on the Fed might be. There could be a scenario where Trump could still appoint someone with some credibility and allow this person to run the show - so that's probably why markets aren't panicking as yet."

ANDREW LILLEY, CHIEF RATES STRATEGIST AT BARRENJOEY, SYDNEY

"Trump is pulling at the loose threads of central bank independence. I don't even believe that he expects that Chair Powell will be charged ... The only reason that he's taking these steps is that he knows that he's not going to take control of the Fed, so he wants to exert as much undue pressure as he can.

"It is not good. Don't get me wrong, but I think it will amount to nothing. Investors won't be happy about it, but it shows actually Trump has no other levers to pull. The cash rate will stay what the majority of the FOMC wants it to be."

(Reporting by Tom Westbrook and Gregor Stuart Hunter in Singapore; Suzanne McGee and Saeed Azhar in New York; Michelle Price in Washington; Scott Murdoch in Sydney; Editing by Muralikumar Anantharaman)