By Matt Tracy

(Reuters) -U.S. corporate borrowers flocked to the investment-grade bond market on Tuesday, seizing on near-record tight borrowing costs and getting ahead of any market volatility sparked by the Federal Reserve's interest rate meeting later this month.

At least 27 issuers tapped the high-grade corporate bond market on Tuesday, according to market participants -- the first day of the Labor Day holiday-shortened week that is historically the busiest of the year for high-grade bond market deal-making.

American pharmaceutical company Merck turned to the bond market for $5 billion to help fund its $10 billion buyout of peer Verona Pharma announced on July 9. Bank of America led that financing, which consists of both shorter- and longer-dated notes and bonds.

Another major bond sale announced Tuesday was health insurer Cigna's $4 billion deal to refinance a soon-maturing term loan and fund general corporate purposes. Citigroup led that transaction.

Automakers Ford and Toyota were also among those that announced bond sales.

All told, Tuesday tallied at least $40.8 billion in high-grade corporate bond sales at market close, according to Hans Mikkelsen, managing director of credit strategy at TD Securities. This was just shy of the $43.2 billion issued the day after Labor Day last year.

That puts the week on track to meet or exceed market forecasts, which had pegged overall high-grade corporate bond issuance at roughly $60 billion, according to several market participants.

"The market was calling for a lot of issuance this week coming off the holiday weekend," said Mike Sanders, head of fixed income at Madison, Wisconsin-based Madison Investments.

TIGHT BOND SPREADS

Corporate bond spreads, or the premium over U.S. Treasuries paid by companies to borrow, have hovered near all-time tight levels in recent weeks. They last averaged 82 basis points (bps), according to the ICE BofA Corporate Index, having increased from a record 75 bp tight level reached on Aug. 15.

The flurry of corporate debt sales impacted prices in the Treasury market too, as investors demanded higher returns to make room for the new debt being sold, pushing Treasury prices lower and yields higher.

The Merck deal and others this week could mark the start of an expected pick-up in M&A-related debt issuance for the remainder of the year, market participants said.

"Those M&A financings have been coming back," said Piers Ronan, head of investment-grade debt syndicate at Truist Securities. "They're not the biggest deals ever but they're going to lead to an overall boost in M&A-related numbers."

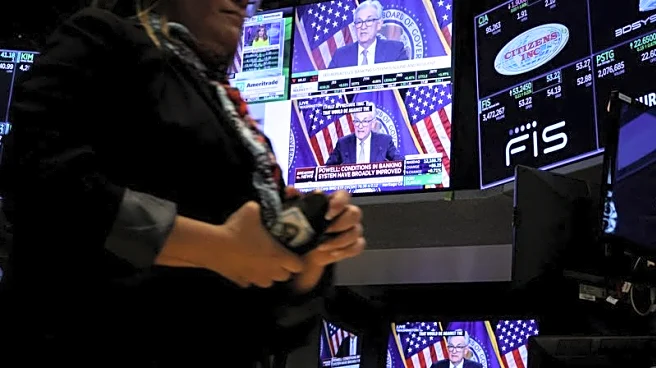

This week's expected issuance flurry comes ahead of the Fed's widely-anticipated meeting from Sept. 16 to 17, where it is expected to cut the fed funds rate by 25 bps.

"For deals that are on the margin, maybe that will bring more ... to the market," said Putri Pascualy, client portfolio manager for private credit at New York-based direct lender Man Varagon.

(Reporting by Matt Tracy; editing by Michelle Price and Nick Zieminski)