By Marcela Ayres

BRASILIA, Jan 28 (Reuters) - Brazil's central bank signaled on Wednesday it would begin cutting interest rates at its next meeting in March, while stressing a "cautious" approach in keeping policy in a restrictive stance in order to bring inflation back to its target.

The central bank's rate-setting committee, known as Copom, voted unanimously to leave its benchmark Selic rate at 15%, the highest level since July 2006, in line with expectations from 32 of 35 economists polled by Reuters.

The forward guidance in the policy statement confirmed a market consensus that rate cuts would begin in March, although policymakers stressed "serenity" regarding the pace and the magnitude of the easing cycle.

The central bank has previously used that word to flag a lower likelihood of aggressive rate moves.

Economists have been split between forecasts for an initial rate cut of 25 or 50 basis points at the next meeting.

Flavio Serrano, the chief economist at Banco BMG, said policymakers were as clear as possible in signaling the start of a rate-cutting cycle.

"Even as they indicate more caution about the potential pace of adjustments, we maintain our view that the central bank will cut the Selic (rate) by 50 basis points in March," he said.

SIGNS OF COOLING ECONOMY

The central bank's rate decision, which was announced on the same day the U.S. Federal Reserve also kept U.S. rates unchanged, follows a year in which Brazil brought inflation under the 4.50% level, the top of the tolerance band for its 3% target, helped by a stronger currency and lower inflation expectations.

Central bank chief Gabriel Galipolo, however, stressed in December that policymakers remained strictly data-dependent for their next monetary policy moves, with all options on the table.

That remark prompted most analysts to bet that the long-awaited easing cycle would begin in March rather than January, amid growing signs that Latin America's largest economy is cooling.

The central bank maintained on Wednesday its annual inflation forecast for the relevant monetary-policy horizon, now comprising the third quarter of 2027, at 3.2%, in line with its December projection.

Policymakers continued to warn that uncertainty about the current outlook calls for caution, even as they judged that the ongoing strategy "has been proving appropriate."

They also noted that a broad set of economic indicators continues to show a moderation in economic activity, as expected, while the labor market still shows signs of resilience. Recent inflation readings, including core measures, have continued to improve but remain above target, the policy statement noted.

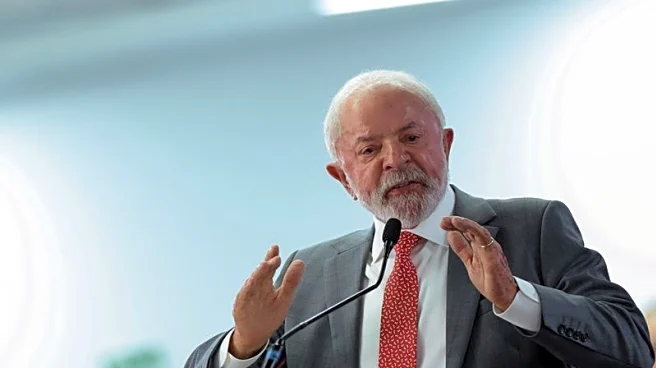

Seven of the central bank's voting directors backed the decision to hold rates steady, with two seats remaining vacant after directors finished their terms in December. Brazilian President Luiz Inacio Lula da Silva has yet to nominate their successors, who must also be confirmed by the Senate.

The central bank halted its aggressive tightening campaign in July after delivering 450 basis points of hikes to slow the economy and steer inflation back to target amid fiscal stimulus from Lula's leftist administration.

(Reporting by Marcela Ayres;Editing by Brad Haynes and Paul Simao)