FRANKFURT, Dec 18 (Reuters) - The European Central Bank kept its policy rates steady on Thursday and took a more positive view on a euro zone economy that has shown resilience to global trade shocks.

Following are highlights of ECB President Christine Lagarde's comments at a news conference after the policy meeting.

INFLATION OUTLOOK

"Inflation should decline in the near term, mostly because past energy price rises will drop out of the annual rates. Staff expects it to stay below 2% on average in '26

and '27. With energy inflation negative over most of this period and inflation excluding energy gradually declining, inflation should then return to target in '28 amid a strong rise in energy inflation."

RESILIENT ECONOMY

"The economy has been resilient. It grew by 0.3% in the third quarter, mainly reflecting stronger consumption and investment."

UNDERLYING INFLATION

"Indicators of underlying inflation have changed little over recent months and remain consistent with our 2% medium term target."

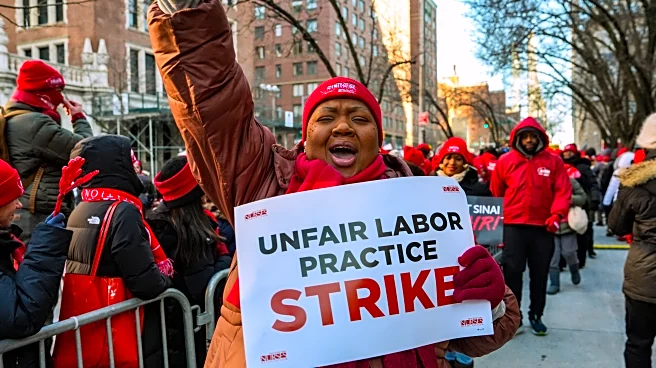

WAGE GROWTH

"Surveys on wage expectations suggest that wage growth will ease in the coming quarters before stabilising somewhat below 3% towards the end of 2026."

TRADE TO DRAG ON GROWTH

"The challenging environment for global trade is likely to remain a drag on growth in the euro area this year and next."

(Reporting by Reuters Global News Desk)