By Jamie McGeever

ORLANDO, Florida (Reuters) -TRADING DAY

Making sense of the forces driving global markets

By Jamie McGeever, Markets Columnist

Gnawing doubts about the frenzy around artificial intelligence

weighed on tech shares again on Wednesday, pushing Wall Street into the red as investors cast a nervous eye toward a key speech from Fed Chair Jerome Powell on Friday.

More on that below. In my column today, I look ahead to Powell's eighth and final Jackson Hole speech. If market moves following his previous seven are any guide, investors should be in for a bumpy ride.

If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today.

1. Trump calls on Fed Governor Cook to resign 2. Fed's dilemma between AI and housing: Mike Dolan 3. Big investors ditch tech ahead of expected Septemberstocks slump 4. US tech-stock stumble shows vulnerability in AI 5. UK inflation heat puts Bank of England back in thespotlightToday's Key Market Moves

Today's Talking Points:

* Trump interference. Investors are increasingly concerned about the involvement - or interference - from President Donald Trump and his administration in many aspects of the economy, private sector business, and independent policymaking.

Trump on Wednesday called for Fed Governor Lisa Cook to resign over mortgage allegations, which could pave the way for another Trump appointee at the Fed inclined to lower interest rates. Commerce Secretary Howard Lutnick, meanwhile, is said to be looking into the government taking equity stakes in Intel and other chipmakers in exchange for grants under the CHIPS Act.

This comes on the heels of Trump's recent sideswipe at Goldman Sachs's CEO and chief U.S. economist, criticism of JPMorgan Chase and Bank of America, his firing of a senior statistics official, and months of verbal attacks on Powell for not cutting rates.

* Tech fatigue. After leading Wall Street's charge this year to new peaks, U.S. tech shares are now losing steam and dragging broader indexes lower. Whether that's simply rotation and diversification, unease over the megacap concentration, or doubts about the huge AI spend, air is coming out of the tech balloon.

The S&P 500 tech sector is down nearly 5% in the last five trading days. But a bit of perspective is required - the sector rallied 60% between April 7 and August 13.

* Fed minutes. With just two days to go until Powell's last Jackson Hole speech, investors on Wednesday had the minutes of the Fed's July 29-30 policy meeting to pore over.

The minutes appear to show that the two policymakers who dissented against the central bank decision to leave rates unchanged appear not to have been joined by others in voicing support for lowering rates at that meeting. "Almost all participants viewed it as appropriate to maintain the target range for the federal funds rate at 4.25% to 4.50% at this meeting," the minutes read.

Maybe the bar to cutting rates is higher than thought? But bear in mind, the weak July payrolls data were released two days after that decision.

Jackson Hole speech could pack a punch

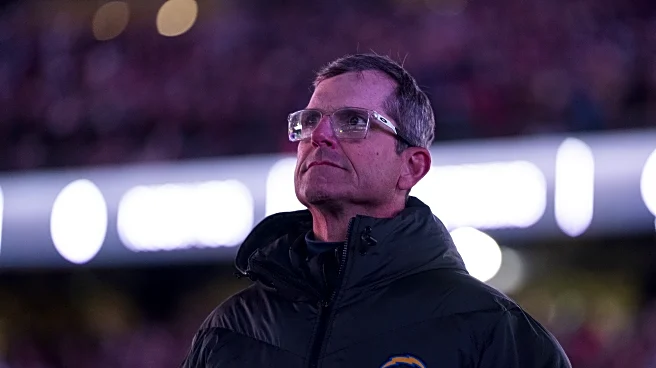

Financial markets are taking in a collective breath ahead of Powell's eighth and final keynote Jackson Hole speech as Federal Reserve chair. If the moves following his last seven are any guide, investors should buckle up for a bumpy ride.

Fed-watchers will be focused squarely on whether Powell signals that he's willing to cut interest rates at the central bank's September 16-17 meeting. His public comments in recent months have been relatively hawkish, but those were all before the release of the weak July employment figures that fired up easing expectations.

Rates futures traders are pricing in an 85% probability of a quarter-point cut next month, with another 25 basis points of easing expected by year's end. Powell's words on Friday could provide significant clarity about whether these positions are "in the money" or not.

Given that traders are betting so heavily on an imminent move, the "pain trade" will be if Powell holds the line that policymakers need to see more incoming data before resuming the easing cycle put on hold in December.

Investors have reason to be cautious. History shows Powell's Jackson Hole speeches tend to move markets a lot, especially the bond market. And even though Powell is often considered a policy dove at heart, his Jackson Hole set-piece speeches have usually pushed yields higher, not lower.

WATCH BOND YIELDS

In the month following each of Powell's last seven Jackson Hole speeches, the 10-year Treasury yield has risen by an average of 21 bps, according to Reuters calculations. The dollar has risen 1.4% and the S&P 500 has fallen nearly 2%, on average, over the same period.

Stretching that out, the S&P 500 has risen an average of 2.3% between the late-August speech and year-end, the dollar has gained 0.4%, while the 10-year yield has climbed 27 basis points on average.

But these averages mask some much bigger moves, especially in the month after the central bank jamboree in Wyoming.

The stand-out example is 2022, when Powell, in his Monetary Policy and Price Stability speech, invoked former Fed Chair Paul Volcker, warning of the "pain" that households and businesses were likely to face from the tight policy needed to slay inflation.

In the following month, the S&P 500 tanked 12%, the dollar rallied 5%, and the 10-year Treasury yield soared 75 bps.

Bond yields climbed at least 20 bps in the month following three other Powell Jackson Hole speeches, in 2018, 2021, and 2023, the latter being another where Powell signaled a readiness to keep rates higher for longer.

KEY CONSIDERATIONS

Inflation today is not as lofty as it was two years ago, but, sitting around 1 percentage point above the Fed's 2% goal, it is higher than Powell would like. Meanwhile, on the other side of the Fed's dual mandate, unemployment remains at a historical low of 4.2%.

This year's theme at Jackson Hole is "Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy." Powell has stated that the unemployment rate is the best measure of the labor market. But that does not mean today's low unemployment rate will automatically lead to a hawkish speech - history shows that when unemployment starts to rise, it can move quickly, leaving the Fed woefully behind the curve.

Markets are probably prepared for some large price swings, whichever way Powell leans.

THE LAST TIME

It's also likely that Powell will use the platform to defend his tenure, just like his predecessors: Alan Greenspan in 2005, Ben Bernanke in 2012, and Janet Yellen in 2017. Given the unprecedented public pressure Trump has placed on Powell to cut interest rates this year, why would the Fed chair not seize this opportunity to have his say?

"He may offer some soft guidance that rates may move lower at a coming meeting. But this is his last speech at Jackson Hole. He may never again have a platform this influential to offer his view of how his history should be written," economists at UBS wrote on Friday.

Will he sign off with a bang? Markets are locked and loaded.

What could move markets tomorrow?

* Australia, Japan, India PMIs (August, flash) * South Korea producer inflation (July) * UK public finances (July) * UK, euro zone PMIs (August, flash) * Canada producer inflation (July) * U.S. weekly jobless claims * U.S. Philly Fed business index (August) * U.S. PMI (August) * U.S. $8 billion auction of 30-year TIPS * U.S. earnings - Walmart * Atlanta Fed President Raphael Bostic speaksWant to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

(By Jamie McGeever; Editing by Rod Nickel)