By Lewis Krauskopf

NEW YORK (Reuters) -With U.S. stocks in the midst of a grim month, investors will look in the coming week for signs of strength in the U.S. consumer with Black Friday putting the spotlight

on the holiday shopping season.

The rally in stocks has stalled in November, with the benchmark S&P 500 declining more than 4% so far during the month. Strong quarterly results from semiconductor giant Nvidia Corp failed on Thursday to calm markets, which have been rattled by concerns about elevated valuations and questions about returns on massive corporate investments in artificial intelligence infrastructure.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity, will now come under Wall Street's microscope.

The trading week will be interrupted by the Thanksgiving holiday on Thursday, followed by Black Friday, known for ushering in discounts, then Cyber Monday and holiday shopping promotions heading into year end.

Recent readings have shown a slump in consumer sentiment, while other data has been missing due to the government shutdown. This could make any signals about holiday spending more significant than usual.

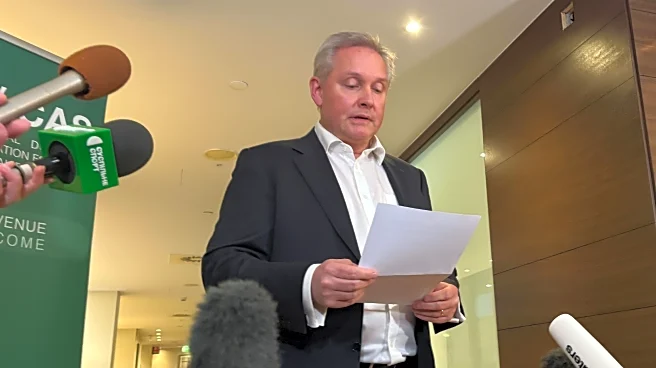

"From a sentiment standpoint, the early reads we get on Black Friday and Cyber Monday, due to the lack of data we have, will be important," said Chris Fasciano, chief market strategist at Commonwealth Financial Network.

"The entirety of the holiday shopping period will be an important read for where we are with the consumer and what that means for the economy."

While the S&P 500 remains up 11% year-to-date, it has declined just over 5% from its late October all-time high. The Cboe Volatility index on Thursday posted its highest closing level since April.

Stock market performance could factor into how consumers spend over the holidays, particularly those with higher incomes who are more invested in equities. Despite the recent wobble, the S&P 500 has soared over 80% since its latest bull market began just over three years ago.

"If you get a pullback there, a lot of the wealth in the upper income is in the stock market ... so it will be interesting to see if they spend like they have in the past," said Doug Beath, global equity strategist at the Wells Fargo Investment Institute.

This month, the National Retail Federation said it expected U.S. holiday sales to surpass $1 trillion for the first time. Still, that November-December forecast equated to growth of between 3.7% and 4.2% from the year-earlier period, slower than the 4.3% growth in 2024.

Household balance sheets are "in a very strong place," yet slowing employment growth could pressure holiday spending, said Michael Pearce, deputy chief U.S. economist at Oxford Economics.

"The most important factor for consumer spending is the health of the labor market," Pearce said.

Data from the delayed monthly employment report released on Thursday showed U.S. job growth accelerated in September. But the unemployment rate increased to a four-year high of 4.4%.

Persistently firm inflation, with import tariffs contributing to higher prices, also could weigh on spending, Pearce said.

Holiday shopping is critical for retailers. Walmart on Thursday raised its annual forecasts in a signal of confidence heading into year end. Reports from other retailers during the week were mixed.

Another read on the consumer will come with Tuesday's release of U.S. retail sales for September. That report has been delayed along with other government releases because of the 43-day federal shutdown that ended earlier this month.

The influx of pent-up data in the coming weeks could further ramp up volatility for investors as they assess the economy's health and prospects that the Federal Reserve will cut interest rates at its December 9-10 meeting.

Following the September jobs report, which will be the last monthly employment release before the next Fed meeting, Fed funds futures late on Thursday reflected a 67% chance the central bank would hold rates steady in December after quarter-point cuts in each of the prior two meetings.

Morgan Stanley economists said on Thursday they no longer expected the Fed to ease in December but they project three cuts in 2026.

"The policy rate path remains highly data-dependent," the Morgan Stanley economists said in a note. "In our view, a mixed report means the committee will want to see more data before taking another step."

(Reporting by Lewis Krauskopf; Editing by Alden Bentley and David Gregorio)