BEIJING, Feb 13 (Reuters) - Oil prices were little changed on Friday after falling in the previous session, and are set for their second weekly decline, on receding concerns of an Iranian conflict that could affect supply and on forecasts supply will exceed demand this year.

Brent crude oil futures were up 3 cents, or 0.04%, at $67.55 a barrel at 0205 GMT after falling 2.7% in the previous session. U.S. West Texas Intermediate (WTI) crude rose 1 cents, or 0.02%, to $62.85 after falling 2.8%.

Brent

prices are set to drop 0.8% this week while WTI is set to fall 1.1%. Prices gained earlier this week on concerns the U.S. could attack key Middle Eastern producer Iran over its nuclear programme but comments on Thursday from U.S. President Donald Trump that the U.S. could make a deal with Iran over the next month drove prices lower in the previous session.

Oil prices are lower "amid signs the U.S. is seeking more time to reach a nuclear deal with Iran, reducing the near-term geopolitical risk premium," IG analyst Tony Sycamore said in a note.

In addition to the receding concerns about a conflict with Iran, the International Energy Agency on Thursday projected in its monthly report that this year global oil demand growth will be weaker than previously expected, with overall supply set to exceed demand.

Thursday's decline was amplified by earlier data showing a massive build in U.S. crude stockpiles and growing anticipation that increased Venezuelan supply could soon hit the market, IG's Sycamore said.

"There is an expectation that Venezuelan oil supply will return to pre-blockade levels in the months ahead," he said, rising from 880,000 barrels per day to about 1.2 million bpd.

The U.S. Treasury will issue more allowances easing sanctions on Venezuelan energy this week, a White House energy official said on Thursday.

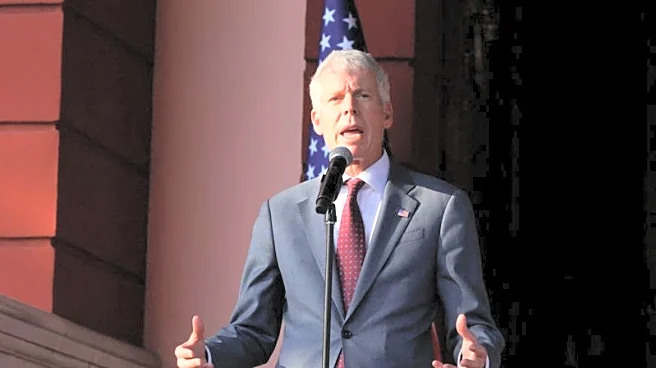

U.S. Secretary of Energy Chris Wright said on Thursday that oil sales from Venezuela controlled by the U.S. have totalled over $1 billion since the capture of President Nicolas Maduro in January and in the next few months will bring in another $5 billion.

(Reporting by Sam Li and Lewis Jackson in Beijing; Editing by Christian Schmollinger)