By Ankur Banerjee

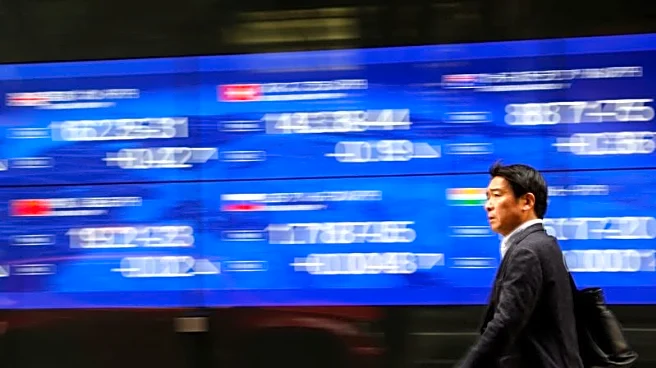

SINGAPORE (Reuters) -Stocks rose and the dollar wobbled on Monday after dismal U.S. labour data sealed the case for rate cuts this month, while the yen fell as investors girded for uncertainty

in Japan following the resignation of Prime Minister Shigeru Ishiba.

Gold prices held near a record high while U.S. Treasury yields hit five-month lows after data showed the world's largest economy created far fewer jobs than expected in August, with markets factoring in chances of a jumbo rate cut.

Much of the focus last week was on elevated long-end bond yields across the globe as investors fretted about the state of various countries' finances from Britain and France to Japan. Some of those worries could return after Japan's Ishiba resigned on Sunday, leading to political uncertainty in the world's fourth-largest economy and clouding the policy path for the Bank of Japan.

The spotlight will be on who replaces Ishiba, with investors fretting that an advocate of looser fiscal and monetary policy, such as Liberal Democratic Party veteran Sanae Takaichi, who has criticised the BOJ's interest rate hikes, could take the helm next.

Yields on super-long Japanese government bonds (JGBs) have already been hovering near record highs, while Japan's Nikkei share gauge has recently slipped from last month's record high.

"The markets are going to be framing this around what it means for fiscal policy, inflation and the BOJ's response," said Kyle Rodda, senior financial market analyst at Capital.com.

"I suspect this will weaken the yen a bit and could actually boost stocks. But the latter relies on some leadership certainty first, so the initial move could be a marginally weaker yen."

The yen fell across the board and was last 0.6% lower at 148.39 per dollar, while the Nikkei rose 1% in early trading.

RATE CUTS ARE HERE

The prospect of an interest rate cut by the Federal Reserve later this month propped up stock markets elsewhere while weighing on the Treasury yields and the dollar.

S&P 500 futures pointed 0.25% higher in early Asian hours on Monday after a volatile session on Friday where the index hit a record high but then closed 0.3% lower. Nasdaq futures advanced 0.25%.

Investor attention this week will be on the U.S. inflation report on Thursday to gauge the risk of rising prices that could help temper some of the enthusiasm for a larger rate cut.

"While most investors remain aligned on a 25 basis point cut at the September Fed meeting, we expect market focus to shift toward calls for a larger move, with a 50bp cut now in play," said Harun Thilak, head of global capital markets North America at Validus Risk Management.

Traders have fully priced in a 25 bp cut later this month with 8% chance of a jumbo 50 bp rate cut, the CME FedWatch tool showed. They are anticipating 68 basis points of easing by the end of this year.

"The Fed has more than enough reasons and will cut by 25bps ... with another two within six-months," said George Boubouras, head of research at K2 Asset Management.

"U.S. cash rates are notably higher than other developed markets (and) given the resilient and robust U.S. economy, lower cash rates are now required. Fed commentary of further rate cuts will be supportive, without this equity markets will be weaker."

In the currency market, the euro eased a bit to $1.1708 after surging 0.6% on Friday, while sterling last fetched $1.3489 after a 0.5% rise on Friday. [FRX/]

Investor attention will also be on France where Prime Minister Francois Bayrou faces a confidence vote on Monday, which he is expected to lose, plunging the euro zone's second-largest economy deeper into political crisis.

In commodities, gold prices were at $3,588 per ounce, just shy of the $3,600 milestone. Gold is up 37% this year after rising 27% in 2024. [GOL/]

(Reporting by Ankur Banerjee; Editing by Jamie Freed)