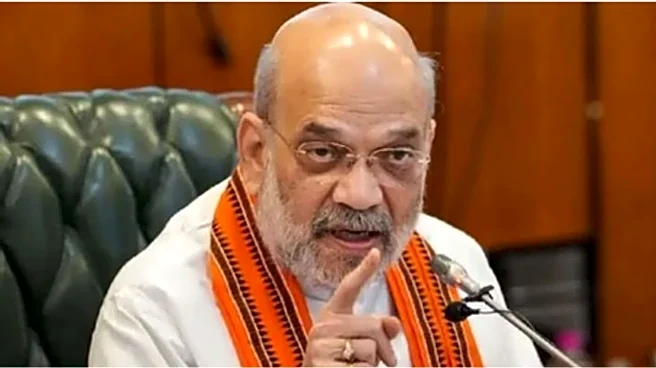

I4C, state police forces, the CBI, the NIA, the ED, the DoT, the banking sector, MeitY, the RBI, and the judiciary are collectively making every possible effort to curb cybercrime, Home Minister Amit Shah said on Tuesday while delivering the keynote address at the National Conference on “Tackling Cyber-Enabled Frauds & Dismantling the Ecosystem”.The Home Minister also asked state police forces to effectively monitor the emergency helpline for cybercrime. “I want to tell the police across the country that you should have sufficient call handlers at your 1930 call centres,” Shah said.Highlighting the menace of cybercrime and the need to monitor it effectively, the Home Minister said, “Cybercrime, which was earlier carried out at an individual

level, is now being executed in an institutionalised manner. Cybercriminals are continuously evolving their methods by using various kinds of advanced technologies.”

Speaking on the occasion, CBI Director Praveen Sood said cybercrime no longer operates from villages in distant districts. “Cybercrime has changed with time. From Jamtara, it has moved overseas to Cambodia,” Sood said.The Home Minister also presided over an Investiture Ceremony of CBI Officers and inaugurated the New Cybercrime Branch of the Central Bureau of Investigation“The initiative by the CBI and I4C is extremely significant and will help connect various government departments and agencies with one another, ensuring effective implementation of their efforts, which will lead to the desired success,” Shah said. The Ministry of Home Affairs has cancelled more than 12 lakh suspicious SIM cards and blocked the IMEI numbers of over three lakh mobile devices. Giving details of how cybercriminals are being identified and action is being taken against them, the Home Minister said, “According to estimates, the total amount of fraud was around ₹20,000 crore, out of which we have frozen or returned ₹8,189 crore to the victims. A total of 20,853 accused persons have been arrested in cybercrime cases.”The Home Minister also asked all private, public, and cooperative banks to immediately adopt the Mule Account Hunter software jointly developed by the Government of India and the Reserve Bank of India. “Until all banks completely clean their accounts using this software, it will not be possible to provide full protection to consumers,” Shah said./images/ppid_a911dc6a-image-177074303034291085.webp)

/images/ppid_59c68470-image-177070253751678670.webp)

/images/ppid_a911dc6a-image-177065992892171021.webp)

/images/ppid_a911dc6a-image-177069628112285222.webp)

/images/ppid_59c68470-image-177070004280967505.webp)

/images/ppid_a911dc6a-image-177057403153775600.webp)

/images/ppid_59c68470-image-177053502527848042.webp)