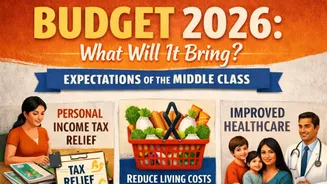

With Budget 2026 just a week away, the talks around the nation are on with speculation about what the Union Finance Minister might announce for the financial

year 2026-27. Beyond economic forecasts and fiscal strategy, many Indian households are focused on something more immediate: relief for everyday living costs. From tax cuts to affordable groceries and improved healthcare, expectations reflect the daily financial pressures facing the middle class.

Reports from Goldman Sachs, Deloitte, EY, and CII suggest that this year, citizens are less concerned with flashy giveaways and more focused on measures that enhance purchasing power, manage inflation, and reduce long-term living costs.

Personal Income Tax Relief Tops Wish List

When the government adjusted income tax slabs in the last budget, it was a welcome move for households. Personal income tax relief remains the most anticipated measure for 2026. Goldman Sachs notes that earlier changes “materially supported household demand and underpinned urban consumption recovery.” Deloitte adds that reductions in tax rates “have bolstered disposable incomes, especially for middle-class households, and helped sustain discretionary spending.”

EY’s Economy Watch adds a cautionary note, reporting that personal income tax collections grew only 6.9 per cent in the first seven months of FY26, a slowdown linked to prior tax rationalisation.

Boosting Everyday Spending Power

Another major expectation is continued rate rationalisation under GST. With the September 2025 revamp, most goods now attract 5 per cent or 18 per cent tax, while luxury items are taxed at 40 per cent. Deloitte observes that these changes benefit youth-heavy spending categories, helping consumers retain more disposable income. Goldman Sachs estimates the GST cuts on mass-consumption products equate to roughly 0.2 per cent of GDP and could drive further demand growth in FY27.

Tackling Inflation, Housing, And Healthcare

Food price volatility, particularly in tomatoes, onions, and potatoes, remains a concern, with CII advocating buffer stocks and decentralised storage to stabilise supply. Housing affordability is another priority; CII recommends extending interest subvention to homes up to Rs 35 lakh and adjusting definitions of affordable housing to reflect real urban market conditions.

Healthcare costs also remain high, with Deloitte highlighting the need for expanded insurance coverage, zero-rated GST on agent commissions, and deductions under Section 80D. CII points out that nearly 40 per cent of health spending is out-of-pocket, and including OPD consultations and diagnostics in insurance coverage could reduce treatment costs by 20 per cent.

Beyond these core areas, proposals include raising duty-free baggage allowances and strengthening the “right to repair” framework to cut electronics replacement costs. Ultimately, Budget 2026 will be judged by its impact on ordinary households, not just macroeconomic numbers.