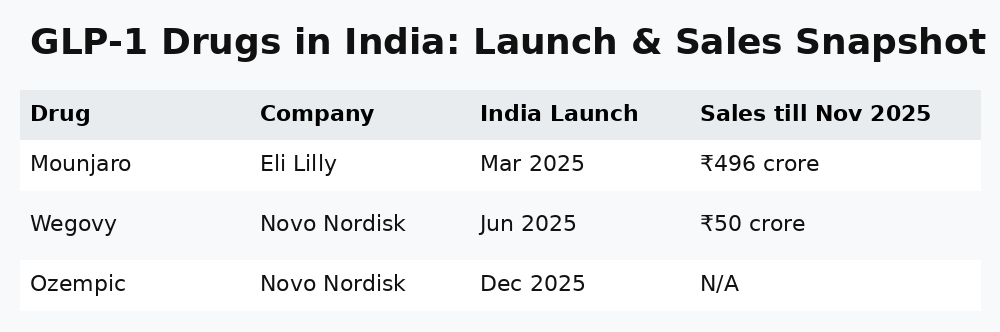

Mounjaro, launched in March 2025 by Eli Lilly, recorded sales of ₹496 crore till November. In contrast, Wegovy, introduced in June by Novo Nordisk, garnered around ₹50 crore in sales. While Wegovy’s revenue trailed sharply, volumes jumped 70% to 45,000 units in November following an almost 40% price cut. Ozempic entered the Indian market only in December, with sales numbers yet to be reported.

Indian drugmakers moved quickly to capitalise on the surge in demand. Cipla partnered Eli Lilly to market tirzepatide under the brand name Yurpeak in October 2025, while Emcure Pharmaceuticals tied up with Novo Nordisk to launch semaglutide as Poviztra a month later.

In a significant legal development, the Delhi High Court also permitted Dr Reddy’s Laboratories, Sun Pharma and OneSource to manufacture and export semaglutide to markets where Novo Nordisk’s patent does not apply.

Why 2026 might be pivotal for weightloss drugs?

Semaglutide is set to lose patent protection across multiple markets in 2026, including Canada, India, China, Brazil and Turkey - regions that together account for roughly a third of the world’s adult obese population. The first expiry is scheduled in Canada on January 4, 2026, followed by India, Brazil and other emerging markets in March.

Canada and Brazil are each estimated to be $1-billion semaglutide markets, with six to seven generic filers expected. However, approvals remain uncertain. In Canada, no generic had received clearance till the end of December 2025.

Dr Reddy’s, one of the key contenders, received a non-compliant certificate from Canadian regulators in October, potentially pushing its launch to the second half of 2026 or even 2027. Street estimates peg Dr Reddy’s semaglutide sales at $100–300 million in FY27–FY28.

In Brazil, analysts expect sharp competition, with prices likely to erode 60–70%, translating into annual revenues of $40–50 million per player.

Read more: Novo Nordisk cuts Wegovy price by up to 33% in India, document shows: Report

India is expected to be the witness the fiercest competition, with Semaglutide's patent expiry in March expected to trigger launches by 10-15 players within the following three months. Prices are also expected to fall at least 50% to around ₹4,000 per month, compared with ₹8,000–10,000 for innovator products.

Companies are also positioning themselves across the value chain, with Ajanta Pharma marketing semaglutide across 23 emerging markets for Biocon, while Biocon itself is targeting Latin America, Asia-Pacific and India. On the manufacturing side, OneSource has more than 20 customers, and Gland Pharma plans to expand GLP-1 capacity to 140 million units by the second half of 2026.

As accessibility and affordability improve, analysts estimate semaglutide could account for 4–5% of India’s pharmaceutical market, adding 1–2% to overall pharma growth over the next few years. Globally, the GLP-1 and weight-loss drug market is estimated to expand sharply, from about $64 billion in 2025 to over $170 billion by 2033.

/images/ppid_59c68470-image-176727004483918603.webp)

/images/ppid_a911dc6a-image-177098224616495837.webp)