The Survey struck a cautiously optimistic note, stating that India’s growth is holding up better than expected even as the global environment remains fragile and downside risks have intensified due to trade fragmentation, geopolitical tensions and rising financial vulnerabilities.

The Survey flagged pressures from global trade actions, noting that the economy faced stress in 2025 from high reciprocal tariffs of 25% and additional

penal tariffs imposed by the US. These measures, it said, added to external headwinds at a time when trade fragmentation and geopolitical tensions were already intensifying.

While domestic fundamentals remain resilient, the Survey warned that the impact of global shocks could surface with a lag, underscoring the need for continued vigilance amid uncertain external conditions.

Also Read: Eco Survey 2026: Govt may consider amending definition of 'government company' for further disinvestment

According to the Survey, domestic demand continues to anchor growth, with rural consumption supported by strong agricultural performance. Urban consumption has also shown improvement, aided by tax rationalisation measures, which have increased disposable incomes.

The economy is currently witnessing broad-based demand momentum, the Survey said, pointing to low inflation, stable employment and rising purchasing power as key factors supporting consumption.

Despite heightened global volatility, India’s external stability was highlighted as a significant strength, with the Survey noting that adequate buffers and a manageable external position have helped contain spillovers from global shocks.

On currency dynamics, the Survey observed that the Indian rupee underperformed in 2025 and is currently “punching below its weight”, with its valuation not fully reflecting India’s strong macroeconomic fundamentals. It said the divergence underscores the influence of global financial conditions despite India’s relative economic resilience.

The Survey highlights gold’s sharp rally as a barometer of global fragility. Gold prices rose from $2,607 per ounce to $4,315 per ounce during 2025, reflecting a weakening US dollar, expectations of persistently negative real interest rates and growing geopolitical and financial tail risks. As of January 26, 2026, gold prices had climbed further to $5,101 per ounce. This surge, the Survey notes, underscores how financial markets are already pricing in structural uncertainty, even as headline global growth and trade have held up better than expected.

Also Read: PM Modi says Budget must focus on reform, perform and transform

The Survey outlined three global risk scenarios for 2026, with the base case being a “managed disorder” scenario, assigned a 45% probability. It also flagged tail risks, including a “systemic shock cascade” scenario with a 10–20% probability, triggered by sharp financial disruptions or geopolitical escalations.

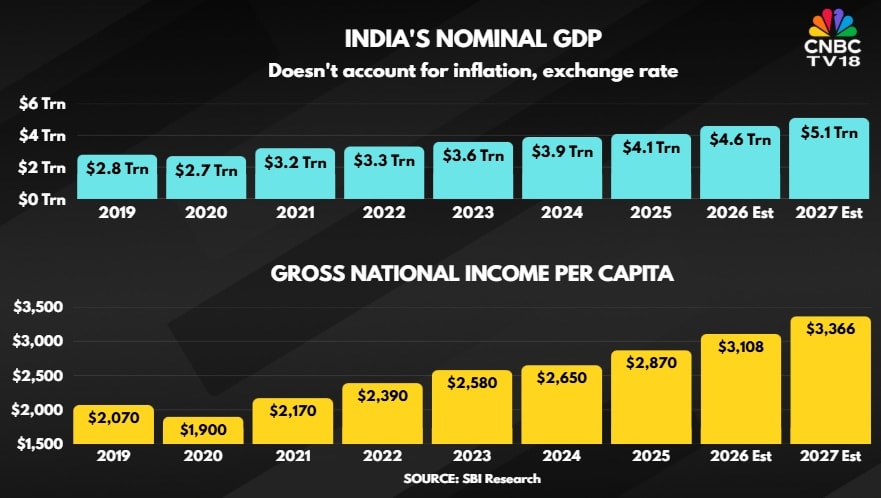

Looking ahead, the Economic Survey said India’s medium-term growth trajectory remains strong, underpinned by ongoing reforms and sustained macroeconomic stability, adding that the country’s overall economic outlook continues to remain positive.

Summing up, the Survey describes India’s challenge as “running a marathon and sprint simultaneously”—maximising growth while building resilience against shocks in a world of permanent uncertainty.

Catch LIVE UPDATES on Economic Survey here.