What's Happening?

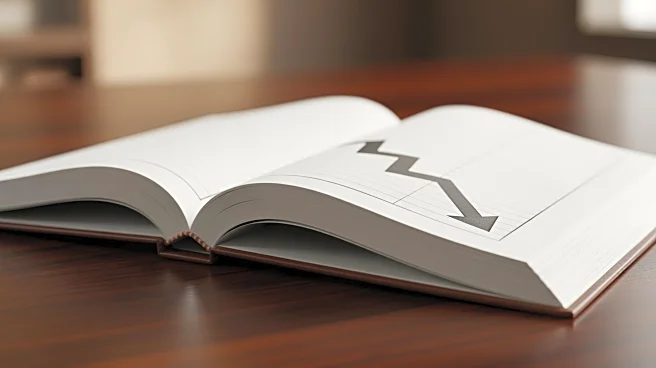

Walmart Stores Inc. announced its first earnings decline in a decade, attributing the drop to its withdrawal from the German market. The company reported a 26% decrease in second-quarter net profit, amounting

to $2.08 billion, following a significant charge of $863 million related to the sale of its German stores to Metro AG. Despite the profit slump, Walmart's sales increased by 11.3% compared to the same quarter in 2005, reaching $84.52 billion. The decision to exit Germany, which was Walmart's third-largest market after the U.S. and Japan, came as a surprise, as the retailer had struggled to establish a foothold in the region over the past eight years. Additionally, Walmart announced the sale of its 16 stores in South Korea, although this did not materially impact its earnings statement.

Why It's Important?

The earnings drop marks a significant moment for Walmart, highlighting the challenges faced by U.S. retailers in international markets. The withdrawal from Germany underscores the difficulties in adapting to local consumer preferences and competitive landscapes. This development may prompt Walmart to reassess its international strategy and focus on strengthening its presence in more profitable markets. The financial impact of the German exit could influence Walmart's future investment decisions and expansion plans, potentially affecting its global growth trajectory. For stakeholders, this situation emphasizes the importance of understanding regional market dynamics and the risks associated with international ventures.