What's Happening?

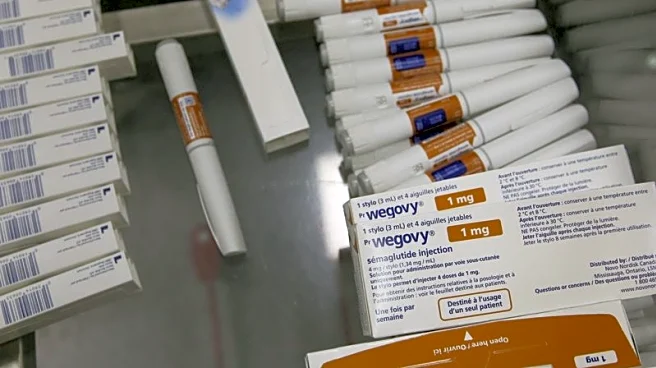

The Dow Jones Industrial Average has surged towards the 50,000 mark, driven by strong fourth-quarter earnings from pharmaceutical giants Eli Lilly and Amgen. This growth is attributed to the high demand for GLP-1 medications, which are used for weight-loss and diabetes treatments. Eli Lilly reported a 43% year-over-year revenue increase, reaching $19.3 billion, with significant contributions from its diabetes treatment Mounjaro and obesity drug Zepbound. Amgen also reported strong earnings, with a revenue of $9.9 billion, exceeding analyst expectations. The healthcare sector's performance has been a key factor in the market's shift away from technology stocks, which have seen a decline due to speculative valuations.

Why It's Important?

The shift in market dynamics

highlights the growing importance of the healthcare sector as a driver of economic growth. The success of GLP-1 medications has positioned pharmaceutical companies as key players in the market, attracting investment that was previously directed towards technology stocks. This trend reflects a broader market preference for companies with tangible cash flows and essential products. The healthcare sector's rise is also influencing regulatory and policy discussions, as the benefits of GLP-1s extend to other health conditions, potentially expanding insurance coverage and long-term revenue potential.

What's Next?

The focus will be on the development of oral GLP-1 medications, which could lower costs and increase patient adherence. Eli Lilly plans to launch an oral GLP-1 pill later in 2026, which could further expand the market. However, the sector faces challenges such as drug price negotiations and potential patent issues. As the tech sector stabilizes, the healthcare sector's dominance may face competition, but strategic pivots towards combination therapies could maintain its competitive edge.