What's Happening?

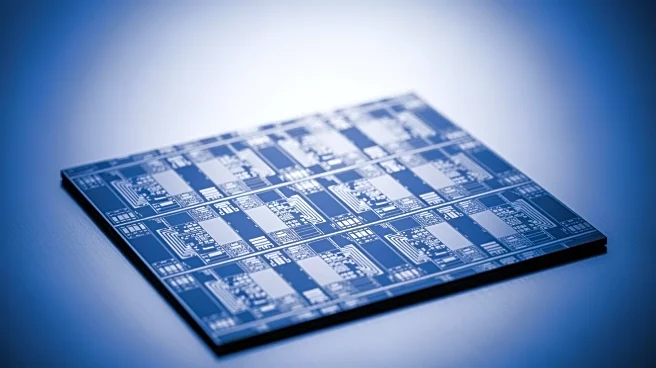

Uniting Wealth Partners LLC has significantly increased its investment in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC), as reported in their latest 13F filing with the SEC. The firm expanded its holdings by 330.9% during the third quarter, acquiring an additional 2,978 shares, bringing their total to 3,878 shares valued at approximately $1.09 million. This move is part of a broader trend where several large investors have been buying and selling shares of TSMC. For instance, Heartwood Wealth Advisors LLC and Fairman Group LLC have also increased their stakes in the company. TSMC, a leading semiconductor foundry, has been performing well in the stock market, with its shares opening at $366.47 recently. The company has a market cap of $1.90

trillion and a strong financial position, as indicated by its current and quick ratios.

Why It's Important?

The increased investment by Uniting Wealth Partners LLC and other institutional investors in TSMC underscores the growing confidence in the semiconductor industry, particularly in companies like TSMC that are pivotal to global technology supply chains. TSMC's robust financial performance and strategic position in the semiconductor market make it an attractive investment. The company's ability to provide advanced chip manufacturing services is crucial for the tech industry, especially as demand for high-performance computing and AI applications continues to rise. This trend could have significant implications for the U.S. tech sector, which relies heavily on semiconductor imports for various applications, from consumer electronics to advanced computing systems.

What's Next?

As TSMC continues to attract investment, it is likely to maintain its leadership position in the semiconductor industry. The company's ongoing innovations and expansions in advanced node technologies will be critical in meeting the increasing demand for semiconductors. Analysts have given TSMC a 'Buy' rating, with expectations of continued growth. The company's strategic decisions, such as potential expansions or partnerships, will be closely watched by investors and industry stakeholders. Additionally, any changes in U.S.-Taiwan trade relations or semiconductor policies could impact TSMC's operations and investor sentiment.