What's Happening?

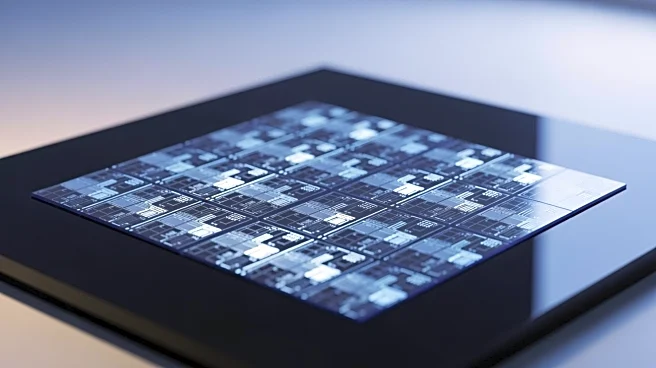

Martin Currie Ltd. has decreased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) by 15.6% during the second quarter, as disclosed in its recent filing with the Securities & Exchange Commission. The firm sold 203,418 shares, reducing its position to 1,099,359 shares, valued at approximately $248.99 million. Despite the reduction, TSMC remains the largest holding in Martin Currie Ltd.'s portfolio, accounting for 9.5% of its total investments. Other institutional investors have also adjusted their stakes in TSMC, with Powers Advisory Group LLC acquiring a new stake, and Hudson Edge Investment Partners Inc. increasing its holdings by 10.1%. TSMC's stock opened at $277.65, with a market capitalization of $1.44 trillion, and has shown

significant growth in its quarterly earnings, surpassing analyst expectations.

Why It's Important?

The reduction in Martin Currie Ltd.'s stake in TSMC is significant as it reflects broader investment trends and confidence levels in the semiconductor industry. TSMC is a major player in the global semiconductor market, and changes in institutional holdings can influence stock performance and investor sentiment. The semiconductor sector is crucial for technological advancements and economic growth, impacting industries such as electronics, automotive, and telecommunications. The adjustments by Martin Currie Ltd. and other investors may signal shifts in investment strategies, potentially affecting TSMC's market position and future growth prospects. Analysts have maintained a 'Buy' rating for TSMC, indicating continued confidence in its performance despite recent changes in holdings.

What's Next?

TSMC has set guidance for its fourth-quarter earnings, and analysts expect the company to post 9.2 earnings per share for the current fiscal year. The firm has also announced an increase in its quarterly dividend, which may attract further investor interest. Equities research analysts have adjusted their price targets for TSMC, with Barclays and Needham & Company LLC raising their targets, reflecting optimism about the company's future performance. As TSMC continues to expand its operations and enhance its technological capabilities, it may face challenges related to global supply chain issues and geopolitical tensions, particularly concerning Taiwan-China relations. Investors and stakeholders will be closely monitoring these developments and their potential impact on TSMC's business operations.