What's Happening?

The U.S. Commerce Department has announced a significant investment of approximately $1.6 billion in USA Rare Earth. This move is part of a strategic effort to reduce the United States' reliance on Chinese

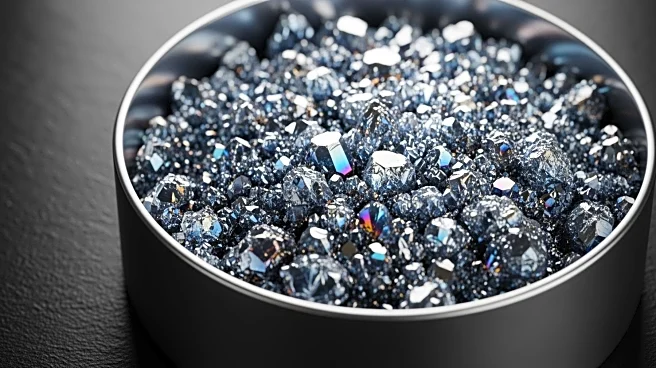

mineral imports by developing a Western supply chain for rare earth elements. The investment includes a $1.3 billion loan under the CHIPS and Science Act and $277 million in direct federal funding. In return, the U.S. government will receive 16.1 million common shares and 17.6 million warrants from USA Rare Earth, potentially giving it an 8% to 16% ownership stake if all warrants are exercised. The funding will support the development of a mine at the Round Top rare earth deposit in Texas and the construction of a permanent magnet manufacturing facility in Stillwater, Oklahoma. These projects aim to establish a complete U.S. supply chain for rare earths, which are critical for various industries, including defense, electric vehicles, and semiconductors.

Why It's Important?

This investment is crucial as it addresses the strategic vulnerability of the U.S. in its dependence on China for rare earth elements, which are vital for modern technologies. China currently dominates nearly 90% of global rare earth production, and past trade tensions have highlighted the risk of supply disruptions. By investing in domestic production capabilities, the U.S. aims to secure its supply chain and reduce geopolitical risks associated with reliance on foreign sources. This move also aligns with previous efforts by the Trump administration to bolster domestic mineral production, reflecting a continued focus on national security and economic independence. The development of U.S.-based rare earth infrastructure could also stimulate job creation and technological advancements within the country.

What's Next?

The next steps involve the execution of the infrastructure projects in Texas and Oklahoma, which are expected to establish a comprehensive domestic supply chain for rare earth elements. The success of these projects could lead to further investments in the sector and potentially attract additional private and public funding. Stakeholders, including policymakers and industry leaders, will likely monitor the progress closely to assess the impact on U.S. mineral independence and economic growth. Additionally, the U.S. government may explore similar investments in other critical mineral sectors to further enhance national security and economic resilience.