What's Happening?

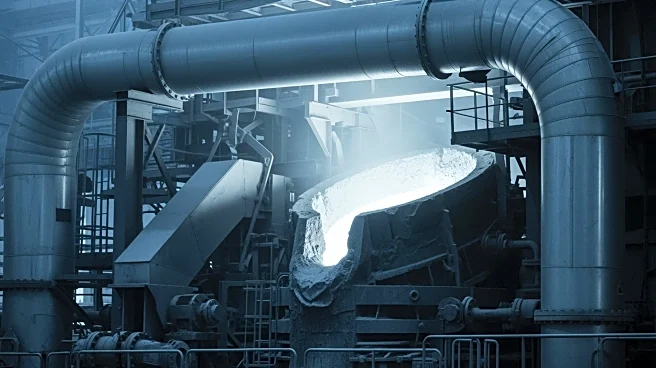

Alcoa Corp. has announced that it is unlikely to restart its aluminum smelter line in Indiana due to the high costs and extended supply chain lead times. President and CEO Bill Oplinger highlighted that the $100 million project would take several years to procure necessary equipment. Despite a significant increase in aluminum prices, which have risen from $1,615 to over $2,170 per ton since October, the company is cautious about expanding capacity. Alcoa's recent financial performance showed a net profit of $226 million in the last quarter of 2025, with aluminum shipments expected to increase in 2026. However, the company's shares fell nearly 3% following the earnings report, although they have seen an 85% increase over the past six months.

Why It's Important?

The decision by Alcoa not to restart the Indiana smelter line underscores the challenges faced by U.S. manufacturers in expanding capacity amidst high costs and supply chain issues. This move could impact the domestic aluminum supply and prices, affecting industries reliant on aluminum. The company's cautious approach reflects broader economic uncertainties and the complexities of navigating tariffs and market demands. Alcoa's decision also highlights the ongoing struggle for U.S. companies to balance investment in domestic production with global market dynamics.

What's Next?

Alcoa's future actions will likely focus on optimizing existing operations and navigating the current economic landscape. The company may explore alternative strategies to enhance profitability without significant capital expenditure. Stakeholders, including investors and industry partners, will be closely monitoring Alcoa's performance and strategic decisions in the coming months. The broader aluminum market may also see shifts as other producers respond to Alcoa's stance on capacity expansion.