What's Happening?

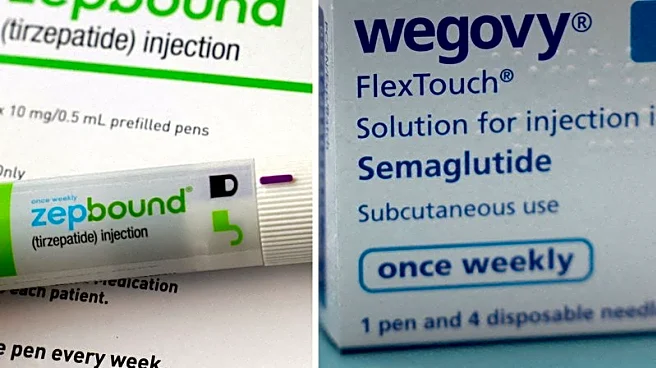

Eli Lilly, a major pharmaceutical company, experienced a 7.4% drop in its stock price following the discontinuation of three clinical pipeline assets. These include a gene therapy for dementia, acquired through a $1.04 billion deal with Prevail Therapeutics, and two other projects: a CD19 antibody and a radioligand therapy. The decision to halt these developments was attributed to a lack of compelling efficacy rather than safety concerns. Despite this setback, Eli Lilly recently reported a strong financial performance, with a 42.6% year-over-year revenue increase to $19.29 billion, driven by high sales of its weight-loss and diabetes drugs, Zepbound and Mounjaro. The company also provided an optimistic forecast for 2026, projecting revenue of $81.5

billion and adjusted earnings per share of $34.25, both surpassing analyst expectations.

Why It's Important?

The discontinuation of these clinical assets highlights the challenges pharmaceutical companies face in drug development, where efficacy and safety are critical. This decision impacts Eli Lilly's pipeline and could influence investor confidence, as reflected in the stock price drop. However, the company's robust financial performance and positive outlook for 2026 suggest resilience and potential for recovery. The strong demand for its existing products, particularly in the weight-loss and diabetes segments, positions Eli Lilly well in a competitive market. Investors and stakeholders will be closely monitoring how the company reallocates resources and adjusts its strategy following these developments.