What's Happening?

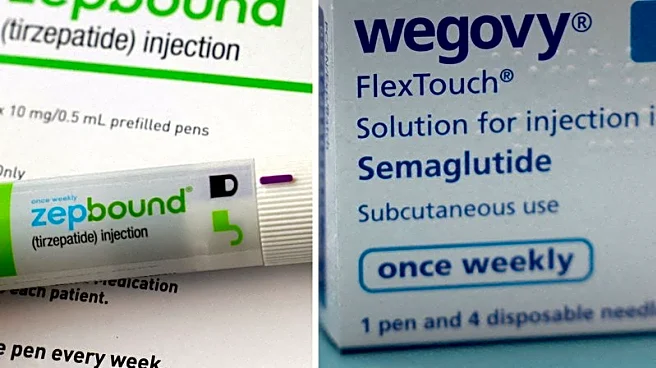

Eli Lilly's stock experienced a 10% increase following the release of its fourth-quarter 2025 financial results, which exceeded Wall Street expectations. The pharmaceutical company reported a 42.6% year-over-year revenue growth to $19.29 billion, with adjusted earnings per share of $7.54. This performance was driven by high demand for its weight-loss and diabetes drugs, Zepbound and Mounjaro. Eli Lilly also provided an optimistic forecast for 2026, projecting revenue of $81.5 billion and adjusted earnings per share of $34.25, both surpassing analyst predictions. The company's shares have shown limited volatility, with only nine significant movements over the past year.

Why It's Important?

Eli Lilly's strong financial performance and positive outlook highlight its

robust position in the pharmaceutical industry, particularly in the weight-loss and diabetes drug markets. The company's ability to exceed expectations and provide an optimistic forecast suggests continued growth potential, which is likely to attract investor interest. The recent FDA Breakthrough Therapy designation for its ovarian cancer drug further underscores Eli Lilly's innovative capabilities and potential for future market expansion. Investors may view the current stock price as an opportunity, given its proximity to the 52-week high and the company's consistent performance.