What's Happening?

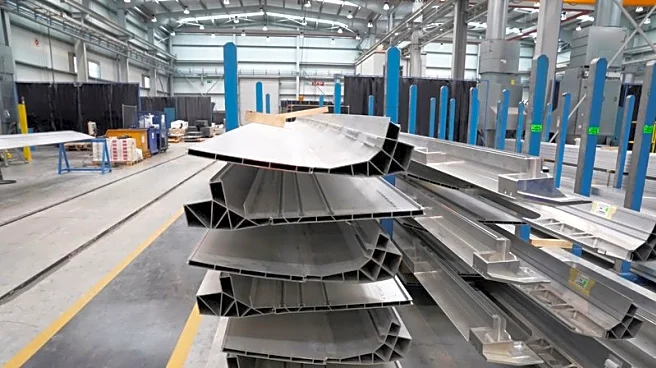

The ocean freight industry is facing significant challenges in 2026 due to a combination of U.S. tariff actions, weakening consumer demand, and an influx of new vessel capacity. In 2025, U.S. tariffs led to a surge in front-loading, which delayed the impact on consumer prices but set up difficult year-over-year comparisons for 2026. Experts from Drewry, Jon Monroe Consulting, and Hackett Associates highlight that these factors, along with the potential reopening of Red Sea routes, are contributing to downward pressure on freight rates and increased market volatility. The introduction of ultra-large 25,000 TEU ships is expected to exacerbate overcapacity issues, further pressuring carrier margins. Carrier alliances and hub-and-spoke scheduling

are being employed to improve schedule reliability, but the overall market remains unstable.

Why It's Important?

This development is crucial for importers, freight planners, carriers, and procurement teams as it affects pricing, contracting strategies, and routing decisions. The combination of policy shifts, demand trends, and fleet capacity changes presents a complex landscape for stakeholders. The ongoing geopolitical risks and structural shifts in trade lanes necessitate strategic planning and tactical adjustments. The potential for lower rates due to increased capacity and the resumption of Red Sea transits could impact profitability and operational strategies for carriers and shippers alike.

What's Next?

Stakeholders in the ocean freight industry may need to adopt more flexible contracting strategies, such as increased reliance on spot markets and flexible minimum quantity commitments (MQCs), to navigate the volatile market conditions. The diversification of trade flows beyond the China-U.S. focus to include regions like Vietnam, Mexico, and Eastern Europe may also influence future logistics and sourcing decisions. As the market adjusts to these changes, companies will need to balance cost efficiency with resilience and adaptability.