What's Happening?

Intel's stock experienced a notable decline following Nvidia's decision to halt its evaluation of Intel's 18A chip-making process. This development underscores the challenges Intel faces in attracting

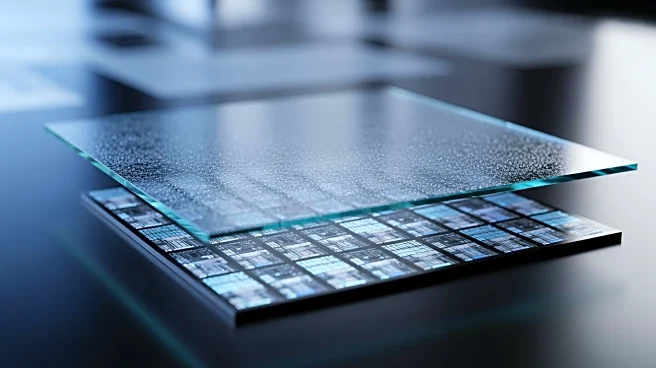

major tech customers to its foundry business. The 18A process was a critical component of Intel's strategy to secure external foundry business, promising improved performance and chip density. Nvidia's decision, as a major player in the AI chip market, led to a 1.5% drop in Intel shares. This situation highlights the competitive pressures within the semiconductor industry and the strategic shifts companies like Intel must navigate to remain relevant.

Why It's Important?

The halt by Nvidia is significant as it reflects the broader competitive landscape in the semiconductor industry, where companies are vying for technological leadership and market share. Intel's ability to attract and retain major customers like Nvidia is crucial for its foundry business strategy. The U.S. government has shown interest in Intel's strategic importance, committing $5.7 billion for a stake in the company. This investment underscores Intel's role in national tech infrastructure, but also places pressure on the company to deliver on its technological promises. The outcome of Intel's foundry ambitions could influence U.S. tech competitiveness and economic security.

What's Next?

Intel's future steps will likely involve reassessing its foundry strategy and addressing the concerns raised by Nvidia's decision. The company may need to enhance its technological offerings or seek new partnerships to regain confidence from major tech players. Additionally, the U.S. government's investment in Intel suggests that there may be increased scrutiny and expectations for Intel to succeed in its strategic goals. The semiconductor industry will be watching closely to see how Intel navigates these challenges and whether it can secure new customers to bolster its foundry business.