What's Happening?

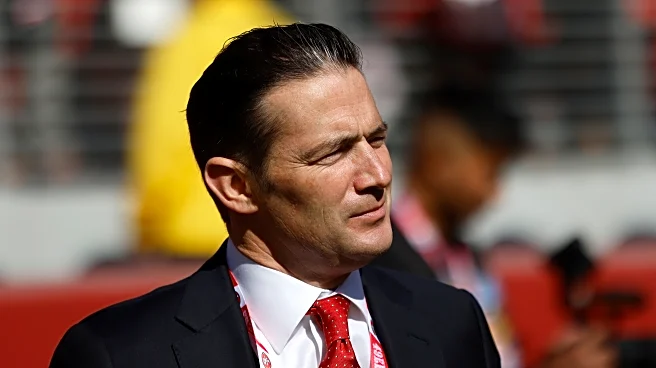

Yext, Inc., a leading brand visibility platform, announced that its CEO, Michael Walrath, has withdrawn his proposal to acquire all outstanding shares of the company not already owned by him. The proposal, initially set at $9.00 per share in cash, was retracted due to Walrath's inability to secure the necessary financing. Despite this, Walrath remains committed to leading Yext, and the company's Board of Directors continues to support his leadership. In response to the withdrawal, Yext's Board, after a comprehensive review by a Special Committee, has approved a 'Dutch auction' self-tender offer to repurchase $150 million of its common stock. This move is aimed at returning capital to shareholders and is expected to commence in February 2026,

with the possibility of using debt financing to fund the tender offer.

Why It's Important?

The withdrawal of the acquisition proposal and the subsequent decision to repurchase stock are significant for Yext's shareholders and the broader market. The self-tender offer represents a strategic move to enhance shareholder value and indicates the company's confidence in its financial health and future prospects. This decision comes at a time when Yext is focusing on leveraging AI to enhance brand visibility and discovery, which could position the company for growth in a competitive digital landscape. The move also reflects a broader trend in corporate America where companies are increasingly using stock buybacks as a tool to return value to shareholders, especially when acquisition opportunities are not feasible.

What's Next?

Yext's planned self-tender offer is subject to certain conditions, including financing, which must be met before the offer can be completed. The company will provide further details in filings with the SEC. Stakeholders will be closely watching the market conditions and stock prices, which will influence the specifics of the tender offer. Additionally, the company's continued focus on AI-driven strategies could lead to further developments in its business model and market positioning, potentially impacting its stock performance and investor interest.