What's Happening?

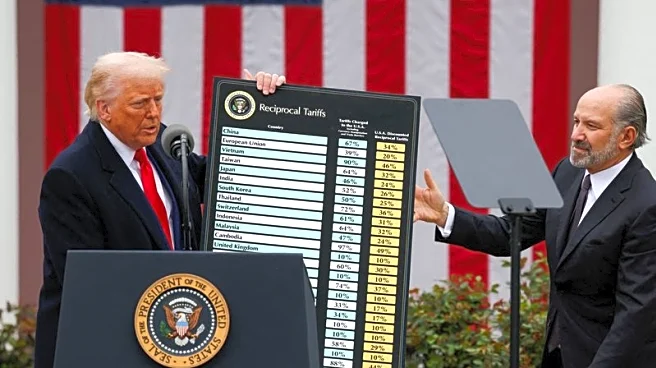

A JPMorgan Chase Institute report highlights the significant impact of President Trump's tariffs on midsize American businesses. The analysis shows that while the tariffs have reduced reliance on Chinese manufacturing, they have also led to increased costs for U.S. companies. Since the implementation of new tariffs in April 2025, monthly tariff payments by midsize firms have tripled. These businesses are seeking alternative suppliers in regions like Southeast Asia, Japan, and India, but the financial burden remains high. The report warns that while trade volumes are stable, the long-term financial health of these companies may be at risk.

Why It's Important?

The report underscores the economic strain that tariffs place on midsize businesses, which are crucial to

the U.S. economy. These firms are particularly vulnerable as they lack the scale to absorb sustained cost increases. The tariffs have led to a shift in supply chains, with companies seeking to bypass high tariffs on Chinese goods. This shift could have long-term implications for global trade patterns and the competitiveness of U.S. businesses. The analysis also highlights the uneven distribution of tariff costs, with existing importers bearing the brunt of the financial pressure.

Beyond the Headlines

The report suggests that the full impact of the tariffs may not yet be visible, as businesses are still adapting to the new trade environment. The long-term effects could include changes in global supply chains and increased costs for consumers. The tariffs may also influence future trade policies and negotiations, as businesses and policymakers assess the effectiveness and consequences of such measures. The findings raise questions about the sustainability of current trade strategies and the need for policies that support the resilience of U.S. businesses in a competitive global market.