What's Happening?

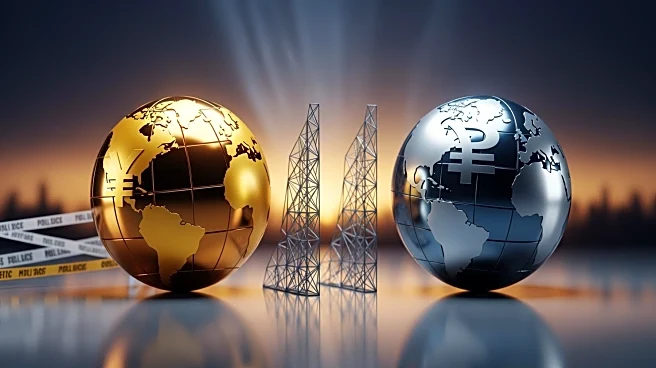

The cryptocurrency market has experienced significant turmoil in recent months, with Bitcoin's value dropping nearly 50% from its all-time high in October. Other cryptocurrencies, such as Ethereum and Solana, have also seen substantial declines. This downturn is particularly painful for crypto enthusiasts who believed the market had reached a stable and mainstream status. The integration of cryptocurrencies into the global financial system, which was expected to stabilize the market, has instead contributed to its volatility. Institutional investors, who were once seen as a stabilizing force, have been quick to sell off assets as prices fall, exacerbating the decline.

Why It's Important?

The current situation highlights the speculative nature of cryptocurrencies,

which rely heavily on market sentiment rather than economic fundamentals. The decline in Bitcoin's value challenges the notion of it being a hedge against inflation, as geopolitical and economic uncertainties have not led to an increase in its value. The mainstreaming of cryptocurrencies has ironically made it harder for them to rebound quickly, as the excitement and radical appeal that once drove their popularity have diminished. This situation poses significant risks for investors and raises questions about the future stability and viability of cryptocurrencies as a legitimate asset class.