What's Happening?

New Insight Wealth Advisors has increased its holdings in Taiwan Semiconductor Manufacturing Company Ltd. (TSMC) by 24.2% during the third quarter, as reported in their latest 13F filing with the SEC.

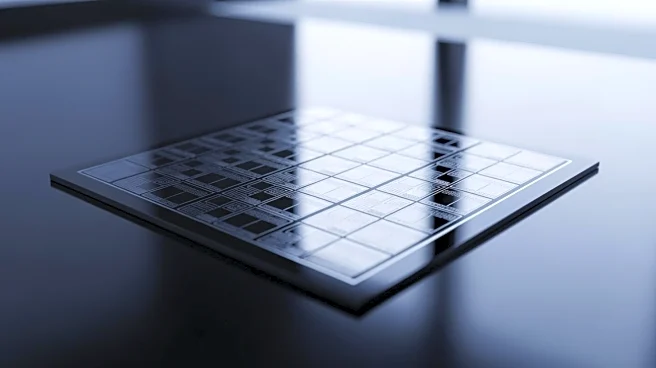

The investment firm now owns 12,241 shares of TSMC, valued at approximately $3.42 million. This move makes TSMC the 22nd largest position in New Insight Wealth Advisors' portfolio. Other major investors have also adjusted their positions in TSMC, with Jennison Associates LLC, Brown Advisory Inc., and Arrowstreet Capital Limited Partnership significantly increasing their stakes in the semiconductor company during the second quarter. TSMC's stock performance has been strong, with a market capitalization of $1.77 trillion and a recent quarterly earnings report showing a net margin of 45.13%.

Why It's Important?

The increased investment in TSMC by New Insight Wealth Advisors and other major investors highlights the growing confidence in the semiconductor industry, which is crucial for technological advancements and economic growth. TSMC is a leading player in the semiconductor market, providing essential components for various technologies, including mobile devices and AI applications. The company's strong financial performance and strategic position make it an attractive investment, potentially driving further interest from institutional investors. This trend could influence the broader market, as semiconductors are integral to numerous industries, impacting everything from consumer electronics to automotive manufacturing.

What's Next?

TSMC's continued growth and investment from major firms suggest a positive outlook for the semiconductor industry. The company's upcoming dividend increase and strong earnings performance may attract more investors, further solidifying its market position. Analysts have given TSMC a 'Moderate Buy' rating, indicating potential for future stock appreciation. As the demand for semiconductors continues to rise, TSMC's strategic investments in advanced technologies and processes could enhance its competitive edge, driving innovation and expansion in the sector.