What's Happening?

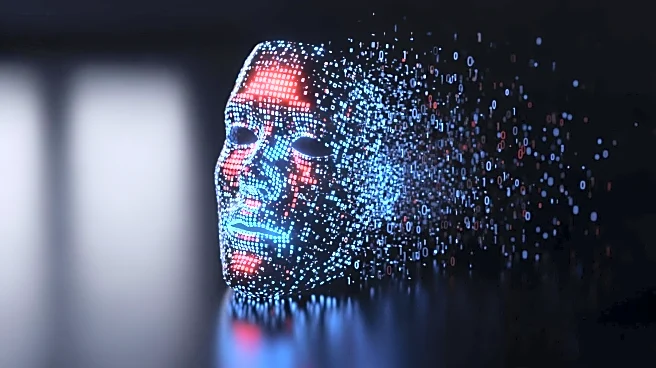

The latest report from Sumsub highlights a significant rise in sophisticated identity fraud attempts, driven by AI and deepfake technologies. Despite a slight decrease in overall fraud attempts, the complexity and effectiveness of these attacks have surged by 180%. These sophisticated frauds involve multiple coordinated techniques, such as synthetic identities and social engineering, making them harder to detect. The report emphasizes a shift from high-volume, low-success fraud to fewer, more damaging attacks, posing a greater threat to victims and institutions.

Why It's Important?

The increase in sophisticated fraud has significant implications for industries reliant on digital identity verification, such as financial services and fintech. As fraudsters employ

advanced techniques, traditional fraud prevention measures are becoming less effective, necessitating a reevaluation of security strategies. The report suggests that organizations must enhance their ability to detect anomalies and adapt defenses in real-time to mitigate these threats. The shift from quantity to quality in fraud attempts underscores the need for improved resilience against increasingly sophisticated attacks.

What's Next?

Organizations are urged to rethink their fraud prevention approaches, focusing on real-time detection and behavioral analysis. The report highlights the importance of adapting defenses to emerging threats, particularly in regions like Europe, where manual fraud prevention processes are still prevalent. As AI and deepfake technologies continue to evolve, businesses must anticipate more sophisticated attacks and strengthen their digital infrastructure to protect against identity fraud.