What's Happening?

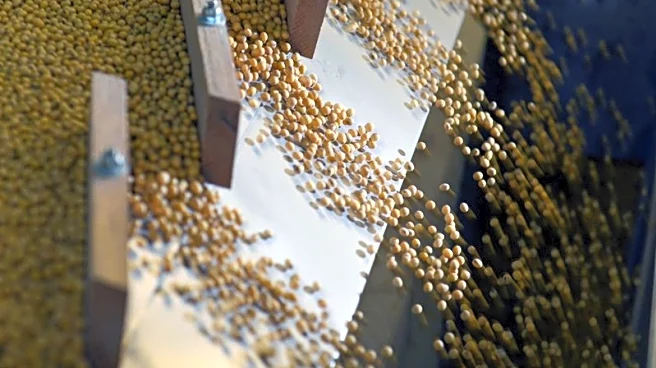

Soybean futures in the U.S. have experienced a decline due to concerns that China may not fulfill its commitment to purchase the expected amount of soybeans. Initially, China had agreed to buy 12 million metric tons of U.S. soybeans by the end of the year, as part of a trade agreement with the U.S. However, as of now, China has only purchased about 3 million metric tons. U.S. Treasury Secretary Scott Bessent has indicated that China will meet its obligation by the end of February, extending the timeline for these purchases. This development has led to a drop in soybean futures, with January delivery prices falling overnight on the Chicago Board of Trade.

Why It's Important?

The decline in soybean futures highlights the volatility in agricultural markets, particularly

in relation to international trade agreements. The U.S. soybean market is significantly impacted by Chinese demand, and any deviation from expected purchase commitments can lead to price fluctuations. This situation underscores the importance of trade agreements and their execution in maintaining market stability. The agricultural sector, including farmers and traders, stands to be affected by these developments, as they rely on predictable demand to plan production and sales strategies.

What's Next?

The U.S. agricultural sector will be closely monitoring China's purchasing activities to assess the impact on soybean prices. If China fulfills its commitment by the extended deadline, it could stabilize the market. However, continued uncertainty may lead to further price volatility. Additionally, upcoming USDA supply and demand reports could provide further insights into market conditions and influence future trading decisions.