What's Happening?

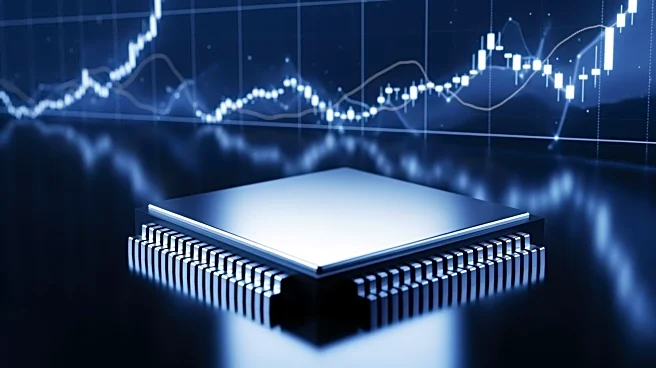

Wall Street's major indexes experienced gains on Friday, driven by a strong performance from chipmakers. Companies such as Micron, Seagate Technology, and SanDisk saw their stocks rise between 2% and 7%,

continuing their upward trend from 2025. The iShares Semiconductor ETF also increased by 2.1%, reflecting investor confidence in the demand for AI-driven chips. Despite these gains, the broader market faced challenges, with concerns over a proposed cap on credit card interest rates affecting lenders' shares. The S&P 500 and Dow Jones Industrial Average both reached new record highs earlier in the week, although the S&P 500 remains just shy of the 7,000-point milestone. Defensive sectors like consumer staples, real estate, and utilities led weekly gains, while financials experienced their worst week since October.

Why It's Important?

The performance of chipmakers highlights the ongoing demand for technology components, particularly those related to artificial intelligence. This sector's strength is a positive indicator for the tech industry and suggests continued investment in AI technologies. However, the proposed cap on credit card interest rates could have significant implications for financial institutions, potentially affecting their profitability and lending practices. The market's mixed performance reflects broader economic uncertainties, including concerns about Federal Reserve policies and potential regulatory changes. These factors could influence investor sentiment and market stability in the coming months.

What's Next?

As the earnings season progresses, results from major companies like Netflix, Johnson & Johnson, and Intel are expected to provide further insights into market trends. Additionally, remarks from Federal Reserve governors may offer clues about future monetary policy decisions. The market will be closed on Monday for Martin Luther King, Jr. Day, but trading will resume with a focus on upcoming economic data and corporate earnings. Investors will be closely monitoring these developments to gauge the health of the economy and the potential impact on various sectors.