What's Happening?

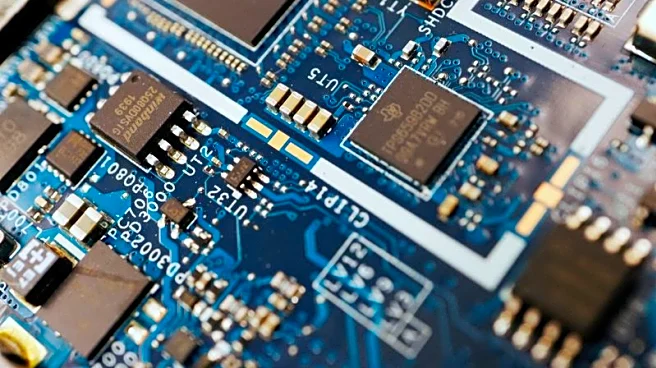

Intel's stock experienced a significant 14% drop following the company's announcement of a net loss for the fourth quarter of 2025. The decline was attributed to the company's inability to meet full product

demand and lower-than-expected production efficiency. CEO Lip-Bu Tan acknowledged the challenges, stating that Intel is on a multiyear journey to improve its manufacturing capabilities. Despite recent investments from the U.S. government, SoftBank, and Nvidia, Intel's guidance for the first quarter of 2026 fell short of market expectations, with projected revenue between $11.7 billion and $12.7 billion and breakeven adjusted earnings per share.

Why It's Important?

The drop in Intel's stock highlights ongoing challenges in the semiconductor industry, particularly in manufacturing and supply chain management. Intel's struggles could impact its competitive position against other chipmakers and affect stakeholders, including investors and technology companies reliant on Intel's products. The company's performance is crucial for the U.S. tech sector, given its role in domestic manufacturing and innovation. The situation underscores the importance of strategic investments and operational improvements to maintain market confidence and drive future growth.

What's Next?

Intel's focus will likely remain on addressing its manufacturing inefficiencies and supply shortages. Investors and analysts will be watching for progress in these areas, as well as any strategic moves to secure new foundry customers. The company's ability to meet its guidance and improve production efficiency will be critical in regaining investor confidence and stabilizing its stock performance.