What's Happening?

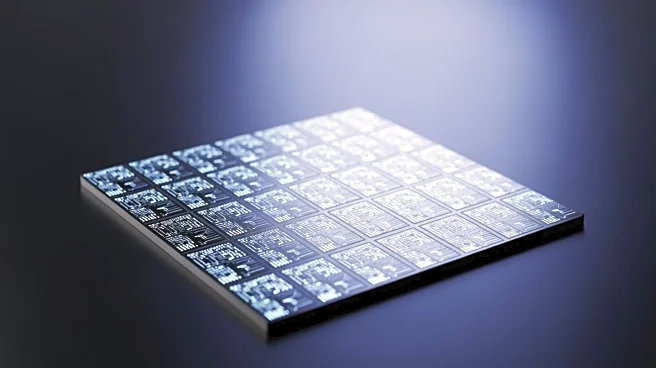

Nvidia has completed a $5 billion purchase of Intel shares, as confirmed in a recent filing. This transaction, initially announced in September, involves Nvidia acquiring over 214.7 million shares of Intel at $23.28 per share. The deal is perceived as a major financial lifeline for Intel, which has been struggling due to past strategic errors and costly expansions in production capacity. The U.S. Federal Trade Commission has cleared Nvidia's investment, ensuring compliance with antitrust regulations. Following the announcement, Nvidia's shares decreased by 1.8%, while Intel's stock saw a slight increase of 0.4%.

Why It's Important?

Nvidia's investment is a significant boost for Intel, providing much-needed financial support as the company navigates through its current

challenges. This move highlights the strategic importance of Intel in the semiconductor industry, particularly as global demand for chips continues to rise. The investment also reflects Nvidia's strategic interest in strengthening its position within the industry by supporting a key player. The clearance by U.S. antitrust agencies indicates regulatory approval, which is crucial for maintaining competitive balance in the tech sector. This development could influence market dynamics and investor confidence in both companies.

What's Next?

With Nvidia's investment, Intel is expected to reassess its strategic priorities and operational efficiencies to leverage the financial support effectively. The semiconductor industry will likely observe Intel's next steps closely, particularly any changes in leadership or strategic direction. Additionally, the regulatory landscape may evolve as authorities continue to monitor the implications of such significant investments in critical technology sectors. Stakeholders will be keen to see how this financial infusion impacts Intel's market performance and innovation capabilities.