What's Happening?

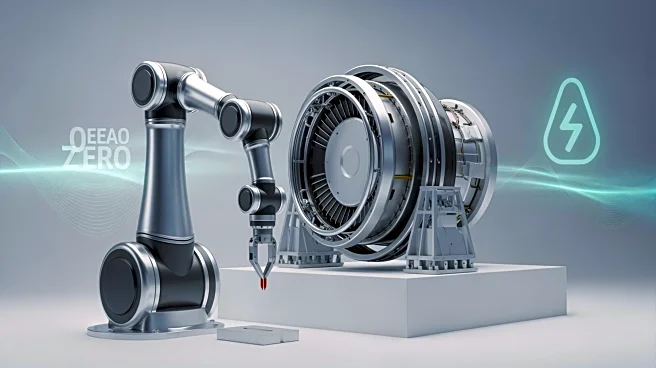

Stanley Black & Decker has entered into a definitive agreement to sell its Consolidated Aerospace Manufacturing (CAM) business to Howmet Aerospace for $1.8 billion in cash. CAM is a prominent provider

of fasteners, fittings, and engineered components for the aerospace and defense industries. The sale is part of Stanley Black & Decker's strategy to enhance shareholder value and focus on its core brands. The transaction is expected to close in the first half of 2026, pending regulatory approval. CAM is projected to generate significant revenue and maintain a strong EBITDA margin, making it an attractive acquisition for Howmet Aerospace.

Why It's Important?

This transaction is crucial for Stanley Black & Decker as it allows the company to reduce its debt and focus on its primary business areas. By divesting CAM, Stanley Black & Decker aims to achieve a more agile capital allocation strategy, enhancing its financial flexibility. For Howmet Aerospace, acquiring CAM provides an opportunity to expand its product offerings and strengthen its position in the aerospace sector. The deal reflects ongoing trends in the aerospace industry, where companies are seeking to optimize their portfolios and focus on high-growth areas.

What's Next?

The completion of the sale is contingent upon regulatory approval and customary closing conditions. Once finalized, Stanley Black & Decker plans to use the proceeds to reduce its debt, aiming for a target leverage ratio. Howmet Aerospace will integrate CAM's operations, potentially leading to synergies and enhanced market competitiveness. Stakeholders in the aerospace industry will be closely monitoring the integration process and its impact on market dynamics.