What's Happening?

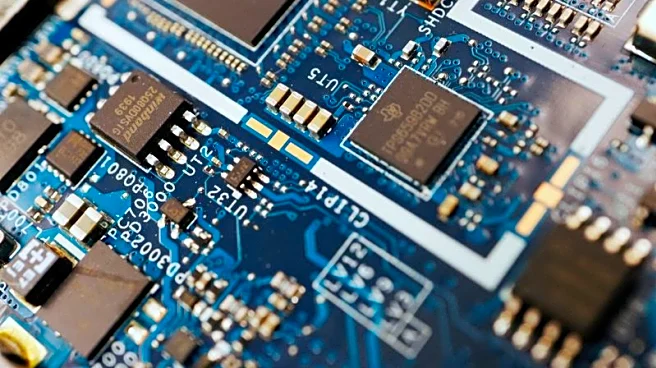

J.P. Morgan has released a report indicating that investments in artificial intelligence (AI) are expected to continue growing, with large U.S. tech companies projected to triple their capital investments by 2026. The firm views AI as a significant economic driver, despite potential challenges such as energy constraints and data privacy issues. J.P. Morgan highlights that while AI investments are justified, the expansion of AI technologies will require addressing infrastructure limitations and regulatory concerns. The report suggests that these factors will influence public policy and investor sentiment.

Why It's Important?

The continued investment in AI underscores its role as a transformative force in the global economy. As AI technologies advance, they have the potential

to revolutionize industries, enhance productivity, and create new market opportunities. However, the challenges identified by J.P. Morgan, such as energy demands and privacy concerns, could shape the pace and direction of AI development. These issues may lead to regulatory interventions and influence how companies allocate resources, impacting the competitive landscape and innovation in the tech sector.

What's Next?

Stakeholders in the AI industry will need to navigate the evolving regulatory environment and address infrastructure challenges to sustain growth. Companies may invest in renewable energy solutions and collaborate with policymakers to ensure compliance with data privacy regulations. As AI technologies become more integrated into everyday life, public discourse around ethical and safety considerations will likely intensify, potentially leading to new standards and practices. The ability of companies to adapt to these changes will be crucial in maintaining their competitive edge.