What's Happening?

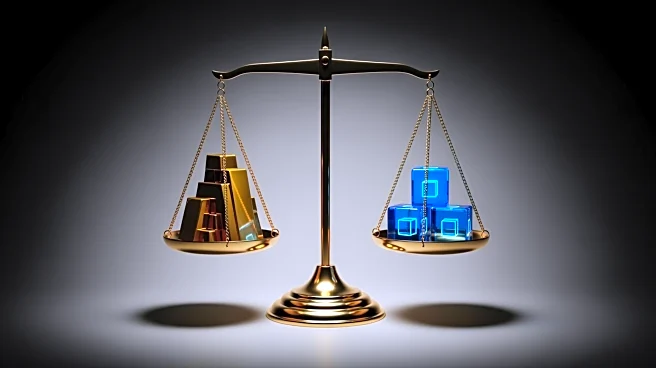

In 2025, U.S. trade policy under President Trump's 'America First' agenda significantly impacted global markets. The introduction of sweeping import tariffs led to increased trade policy uncertainty. Despite

these challenges, the U.S. economy showed resilience, with GDP growth reaching 4.3% in the third quarter. Concurrently, the U.S. dollar experienced a notable decline, falling 10% against major currencies, marking its worst performance in decades. This decline was contrary to initial expectations of dollar strengthening due to U.S. economic policies.

Why It's Important?

The shifts in U.S. trade policy and the dollar's decline have broad implications for global economic dynamics. The increased tariffs represent a significant shift in U.S. economic strategy, affecting international trade relations and potentially leading to retaliatory measures from other countries. The dollar's decline impacts global trade balances and could influence foreign investment in the U.S. These developments highlight the interconnectedness of global markets and the potential for U.S. policies to drive significant economic shifts.

What's Next?

As 2026 approaches, the continuation of current trade policies and their impact on the global economy will be closely monitored. The potential for further tariff adjustments and their effects on international trade relations remains a key area of focus. Additionally, the trajectory of the U.S. dollar will be critical in shaping global economic conditions. Stakeholders will need to assess the long-term implications of these policies on economic growth and stability.