What's Happening?

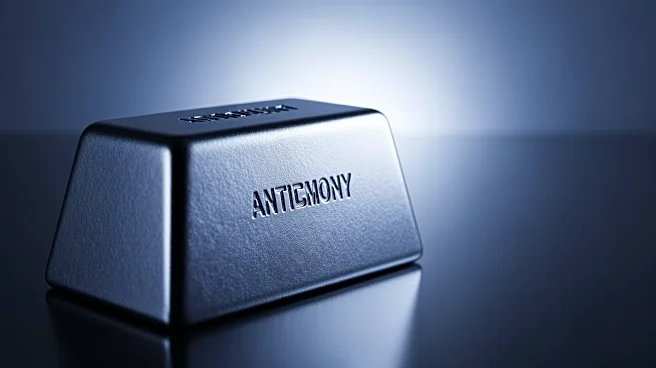

Antimony Resources Corp has listed its shares on the OTCQB market, aiming to increase its exposure and liquidity in the United States. The Canadian mining company, focused on antimony, announced this strategic move on November 18, 2025. The decision comes amid high demand for antimony in the U.S., driven by its critical role in military technology, ammunition, lead-acid batteries, flame retardants, semiconductors, and solar equipment. The company has a flagship exploration project in New Brunswick and recently filed an NI 43-101 Technical Report for the Bald Hill property, which could potentially yield up to 108,000 tonnes of antimony. Despite the optimism surrounding the new listing and drill results, the cyclical nature of antimony prices

poses a risk to the project's economics.

Why It's Important?

The listing on the OTCQB market is a significant step for Antimony Resources as it seeks to tap into the U.S. capital markets, potentially increasing its investor base and liquidity. Antimony is a critical mineral with rising demand due to its applications in various industries, including military and technology sectors. The move could position the company to better capitalize on the growing interest in antimony, especially as prices have surged since early 2024. However, the volatility in antimony prices could impact the company's financial stability and project viability, highlighting the importance of strategic planning and market analysis.

What's Next?

Antimony Resources is completing a 6,000-meter drill program to assess the viability of producing a mineral resource estimate. The company will need to navigate extensive permitting, environmental assessments, and funding challenges to transition from exploration to production. The success of these efforts will depend on maintaining favorable market conditions and securing necessary approvals. Stakeholders, including investors and industry partners, will be closely monitoring the company's progress and market dynamics.