What's Happening?

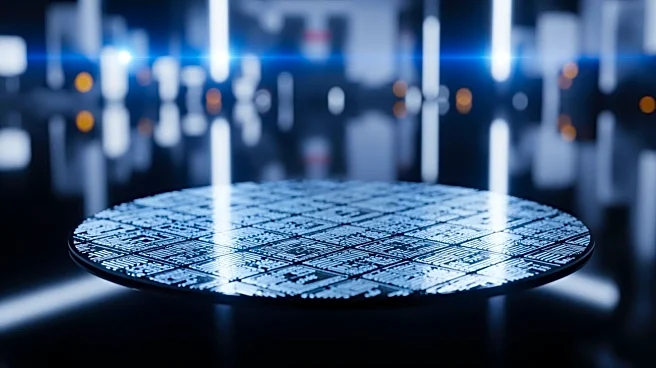

Taiwan Semiconductor Manufacturing Company (TSMC) has announced a significant increase in its fourth-quarter profit, driven by a surge in demand for artificial intelligence (AI) chips. The company reported

a 35% rise in net income compared to the previous year, marking its eighth consecutive quarter of profit growth. TSMC's revenue for the October-December period exceeded NT$1 trillion for the first time, surpassing market expectations. The company's high-performance computing division, which includes AI and 5G-related chips, accounted for the majority of its revenue. Advanced chips measuring 7 nanometers or smaller made up 77% of total wafer revenue during the quarter. TSMC has also announced plans to increase its capital spending by 37% in 2026, reflecting confidence in sustained demand for advanced manufacturing technologies.

Why It's Important?

TSMC's record profit highlights the growing importance of AI technology in the semiconductor industry. As the world's largest contract chipmaker, TSMC plays a crucial role in the global supply chain, particularly for major technology clients like Nvidia and AMD. The company's strong financial performance underscores the increasing demand for advanced processors, which are essential for AI workloads. TSMC's planned $100 billion investment in the U.S., including $65 billion for three plants in Arizona, signifies its commitment to expanding its presence in the American market. This move could have significant implications for the U.S. semiconductor industry, potentially boosting domestic production and reducing reliance on foreign suppliers.

What's Next?

Looking ahead, TSMC expects its first-quarter revenue to rise by as much as 40% from the previous year, reaching $35.8 billion. The company plans to continue expanding its production capacity, particularly in advanced packaging and 2-nanometer technology. However, potential challenges remain, including trade uncertainties related to U.S. tariffs on semiconductors. Despite these risks, TSMC's ongoing investments in the U.S. and its strong market position suggest continued growth in the coming years. Analysts remain optimistic about the company's prospects, although they caution that demand for consumer electronics could be affected by memory shortages and rising prices.