What's Happening?

Mercedes-Benz Group has reported a significant 57% drop in its full-year operating profit, amounting to 5.8 billion euros ($6.9 billion) for 2025. This decline is attributed to increased tariff costs, intense competition from Chinese automakers, and foreign exchange headwinds. The company's earnings fell short of analyst expectations, which were set at 6.6 billion euros. Despite these challenges, Mercedes-Benz maintained that its financial results were within guidance due to a focus on efficiency and flexibility. The automaker's shares fell over 5% following the announcement, reflecting investor concerns over the company's future performance amid these ongoing challenges.

Why It's Important?

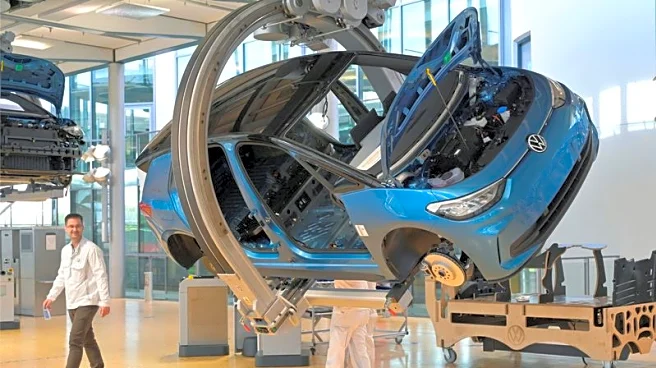

The significant drop in Mercedes-Benz's profits highlights the broader

impact of global trade tensions and competitive pressures on the automotive industry. Tariffs have increased operational costs, affecting profitability and potentially leading to higher prices for consumers. The competition from Chinese automakers underscores the shifting dynamics in the global automotive market, where traditional European manufacturers face growing challenges from emerging markets. This situation could influence strategic decisions within the industry, including potential shifts in production locations, pricing strategies, and investment in new technologies to maintain competitiveness.

What's Next?

Mercedes-Benz and other European automakers may need to reassess their strategies to mitigate the impact of tariffs and competition. This could involve lobbying for favorable trade agreements, investing in local production facilities in key markets, or accelerating the development of electric vehicles to differentiate from competitors. Additionally, the company might explore cost-cutting measures or strategic partnerships to enhance its market position. Stakeholders, including investors and industry analysts, will be closely monitoring the company's next moves and any potential policy changes that could affect the automotive sector.