What's Happening?

North American Construction Group Ltd (NACG) has announced a definitive agreement to acquire Iron Mine Contracting (IMC), a diversified mining services contractor based in Western Australia. The acquisition,

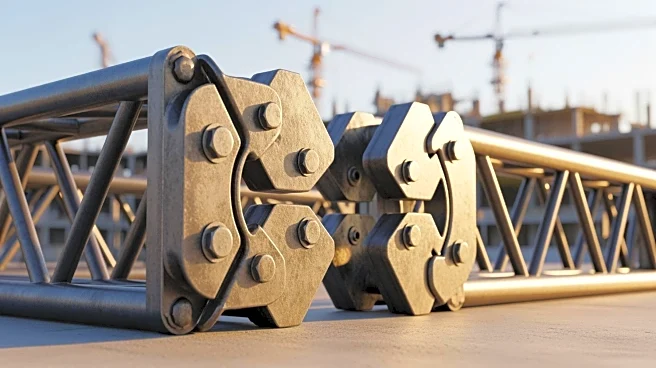

valued at approximately C$115 million, is part of NACG's strategy to expand its operations in the Australian market. IMC provides a range of services including contract mining, crushing, and civil services, and has a strong order book exceeding C$1.0 billion. This acquisition is expected to enhance NACG's presence in key commodity sectors such as gold, iron ore, and lithium. Joe Lambert, President and CEO of NACG, highlighted the strategic alignment and operational excellence shared between the two companies, which will facilitate NACG's growth in the region.

Why It's Important?

This acquisition is significant as it positions NACG as a Tier 1 contractor in Australia, capable of executing complex projects across the country. The move increases NACG's exposure to rare earth and critical minerals, which are crucial for various industries, including technology and renewable energy. By leveraging IMC's established market presence and operational capabilities, NACG aims to accelerate its growth in unit rate work, which is characterized by higher margins and lower capital requirements. This strategic expansion not only diversifies NACG's geographic and commodity portfolio but also strengthens its competitive edge in the global mining services industry.

What's Next?

Following the acquisition, NACG plans to integrate IMC's operations with its existing Australian partner, the MacKellar Group, to enhance its service offerings and client base. The company is also set to commence new projects in Australia by the second quarter of 2026, utilizing its expanded fleet and resources. Additionally, NACG has executed a purchase and sale agreement to optimize its Canadian oil sands fleet, which includes the sale of 26 haul trucks and the acquisition of eight Komatsu trucks in Australia. These strategic moves are expected to support NACG's growth objectives and operational efficiency in the coming years.