What's Happening?

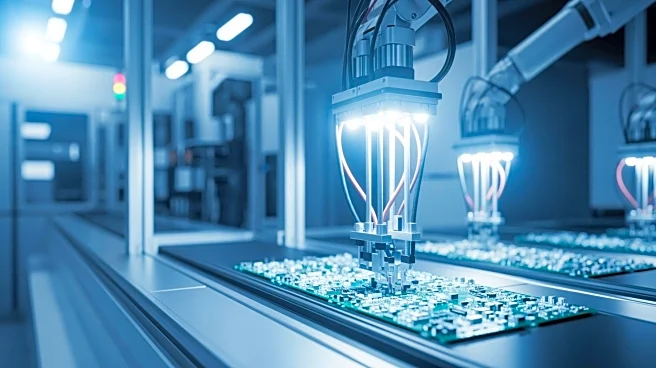

Vishay Intertechnology, Inc., a global manufacturer of discrete semiconductors and passive electronic components, has announced plans to expand its manufacturing capacity. The company is focusing on high-growth product lines, with capital expenditures projected between $400 million and $440 million in 2026. This expansion includes the Newport wafer fab and a new 12-inch wafer fab in Germany. Vishay aims to support mega trends such as e-mobility, sustainability, and connectivity. Despite facing challenges like supply chain disruptions and market cyclicality, Vishay is committed to innovation and customer-driven growth solutions. The company also plans to maintain its dividend and repurchase shares based on available liquidity.

Why It's Important?

Vishay's expansion

efforts are significant as they align with global trends in e-mobility and sustainability, potentially positioning the company as a key player in these sectors. The expansion could lead to increased production capacity, meeting rising customer demand and potentially boosting the company's market share. However, the company faces risks such as supply chain disruptions and market cyclicality, which could impact its operations and financial performance. Successful execution of these expansion projects could enhance Vishay's competitive edge and financial stability, benefiting stakeholders including investors and customers.

What's Next?

Vishay plans to continue its capacity expansion projects while managing associated risks such as design and construction delays. The company is also considering additional financing options to support its growth plans. As Vishay expands its product lines and manufacturing capabilities, it will likely focus on leveraging insights into customer demand to drive innovation. The company's strategic initiatives, including the Vishay 3.0 plan, aim to position it for future megatrends, potentially leading to long-term growth and increased shareholder value.