What's Happening?

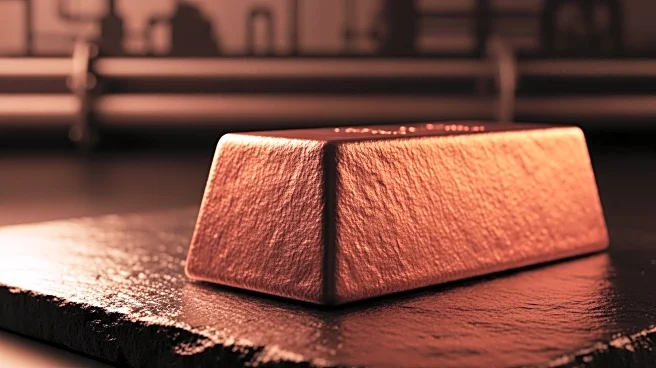

Copper prices have reached an unprecedented $12,000 per ton, marking a significant milestone for the metal. This surge is attributed to a combination of supply constraints and increasing demand driven by technological advancements and the global energy transition. The market is facing a structural deficit, with a projected shortfall of 19 million metric tons by 2050 unless new mining and recycling initiatives are developed. The Global X Copper Miners ETF has seen a 93.14% increase in 2025, reflecting investor confidence in the metal's future. Supply issues are exacerbated by mine disruptions, declining ore grades, and operational challenges in key regions, while demand continues to grow across sectors such as electrification, renewable energy,

and advanced manufacturing.

Why It's Important?

The surge in copper prices highlights the critical role the metal plays in the global economy, particularly in the context of the energy transition and technological development. As copper is essential for power grids, electric vehicles, and renewable energy systems, its rising cost could impact the pace and cost of these initiatives. The projected supply deficit underscores the need for investment in new mining projects and recycling facilities. This situation presents both challenges and opportunities for stakeholders, including mining companies, investors, and governments, as they navigate the balance between meeting demand and addressing environmental and community concerns.

What's Next?

Chile, the world's largest copper producer, is poised to benefit from the current market dynamics. The country has plans for 13 copper projects worth approximately $14.8 billion, with several expected to begin operations by 2026. These projects aim to add significant capacity, although full ramp-up may take years. The role of local communities in project approvals remains crucial, especially as Chile prepares for a change in administration in March 2026. The focus on brownfield expansions and productivity gains suggests a cautious approach to increasing output, which may influence global supply dynamics in the coming years.